When it comes to investing in the stock market, one question towers above all others: What is a stock really worth? This is the essence of stock valuation, the process of determining the intrinsic value of a company’s shares. As investors, our goal is to buy stocks when they are undervalued and sell when they are overvalued. But how do we know what “value” truly means? Let’s dig into the heart of company stock valuation and why it matters so much for your long-term financial success.

At its core, stock valuation is the analytical process of determining the fair value of a company’s shares. This isn’t just about looking at the current market price; it’s about understanding what the business is worth based on its fundamentals, earnings power, growth prospects, assets, and risks.

There are several approaches to share valuation. Some investors prefer the simplicity of the price-to-earnings (P/E) ratio, while others dig deeper with discounted cash flow (DCF) analysis or Benjamin Graham’s intrinsic value formula, still a reliable and timeless method for assessing value despite its imperfections. The key is to use these valuation tools to separate the signal from the noise in the ever-volatile world of stock market valuation.

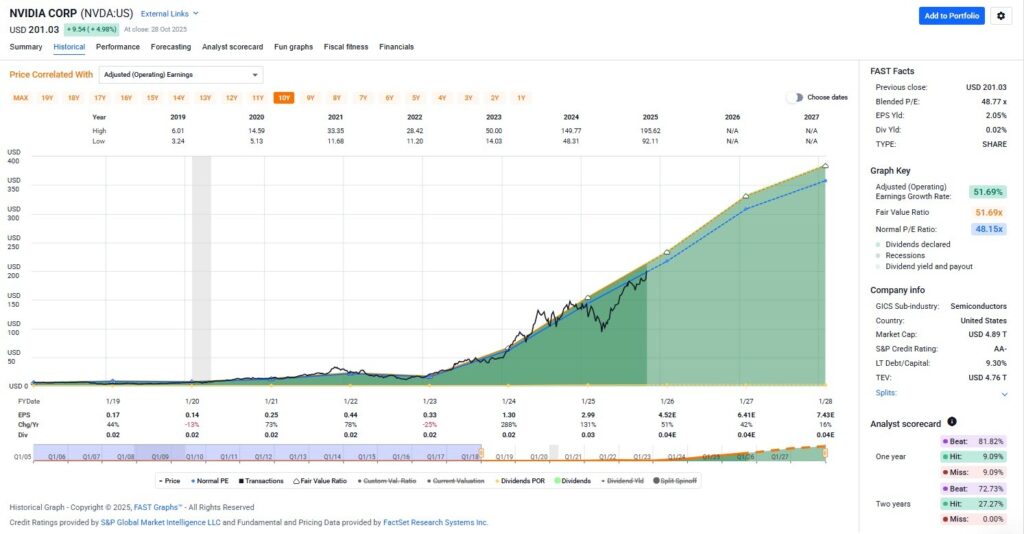

The FAST Graphs fundamentals analyzer software tool clearly expresses the relationship between stock prices and fundamental values over the long run. It incorporates all these methodologies to illustrate intrinsic value while providing real-world evidence of the reliability of those valuation models.

Imagine walking into a store and seeing two identical products, one priced at $10, the other at $20. Which would you buy? The answer seems obvious, but in the stock market, prices are constantly changing, and the “product” (the company) is evolving as well. Valuation in stocks helps you determine whether you’re getting a bargain or overpaying for enthusiasm.

When you buy a stock without considering its valuation, you’re essentially speculating. But when you anchor your decisions in sound valuation principles, you become a true investor, someone who understands the difference between price and value.

The stock market is a voting machine in the short term and a weighing machine in the long term. Prices can swing wildly based on news, sentiment, or macroeconomic factors. However, over time, the market rewards companies that grow earnings and generate value for shareholders. That’s why focusing on stock market valuation, not just short-term price movements, is essential for building lasting wealth.

Let’s break down the main approaches to company stock valuation:

Each method has its own strengths and weaknesses, but together they paint a more complete picture of a company’s true worth.

Market sentiment, the collective attitude of investors, plays a powerful role in shaping stock valuations in the short run. While valuation methods focus on fundamentals such as earnings, cash flow, and growth, sentiment can temporarily drive prices above or below fair value. However, in the long run, fundamentals always prevail. Recognizing when the market misjudges a stock’s value is the key to minimizing risk and achieving superior long-term returns.

When investor sentiment turns optimistic, stocks often trade at higher valuation multiples. This is especially true during bull markets, when enthusiasm and confidence push prices beyond what fundamentals might justify. Conversely, in periods of fear or pessimism, such as market corrections or recessions, valuations can fall sharply, even for fundamentally sound companies.

For instance, during phases of high investor optimism, stock market valuations often reflect excitement more than reality. When sentiment shifts, valuations can quickly contract, revealing how emotional markets can be.

Market sentiment is highly sensitive and can change overnight. After a stretch of optimism, when valuation multiples expand, the market becomes vulnerable to corrections if sentiment cools. Even small changes, triggered by earnings reports, economic data, or global events, can lead to major swings in stock market valuation.

Interestingly, negative sentiment tends to have a more pronounced and lasting impact on stock prices than positive sentiment. Fear drives prices down faster and further than optimism drives them up.

Behavioral finance has shown that investor psychology and emotions significantly influence short-term price movements. Retail investors, in particular, can amplify sentiment-driven buying and selling, creating price deviations from intrinsic value. This is why periods of euphoria can lead to bubbles, while fear can present undervalued opportunities for disciplined investors.

Recent examples abound. Companies like Apple and Nvidia have seen their stock valuations surge amid investor optimism surrounding innovation and technology trends, sometimes reaching levels that reflect excitement as much as fundamentals.

In the end, stock valuation is both an art and a science. It requires a thoughtful blend of quantitative analysis and qualitative insight. By mastering the principles of company stock valuation and maintaining a disciplined approach to share valuation, investors can navigate the market’s emotional tides with confidence.

Remember, while market sentiment comes and goes, value endures. As “Mr. Valuation,” I remind investors: focus on what a business is truly worth, not merely what it’s trading for today. That’s the surest path to consistent, long-term investment success.

FAST Graphs™ is a stock research tool that empowers subscribers to conduct fundamental stock research deeper and faster than ever before.