20 Stocks

Most investors take their cue from stock price volatility. They get attracted to stocks whose prices are rising and tend to run for the hills when prices are falling. However, in the long run fundamentals matter much more than stock prices. Growing fundamentals lead to long-term returns, while shrinking fundamentals ultimately lead to losses. Consequently, it really does not matter if the stock price is rising or falling. What matters most is when fundamentals are rising or falling.

In this context, value investing is rooted in identifying bargains. However, bargains are rarely found in highly popular stocks. Instead, the best value can be found when stocks are temporarily out of favor. To paraphrase the venerable Marty Whitman manager of the Third Avenue Value Funds, it is implicit that investors recognize the distinction between a temporary interruption in a great and profitable business versus a permanent impairment of capital. This is where research and due diligence come into play. The prudent and intelligent investor looks to find bargains in great companies that are temporarily on sale. In the long run, this is where the real money is safely earned.

In this subscriber request video, I have chosen 20 stocks requested by subscribers that clearly illustrate the importance of fundamentals. As I go through each of the stocks, note how the stock price always moves into alignment with fundamental value – in the long run. Therefore, focus on fundamentals first and stock price second.

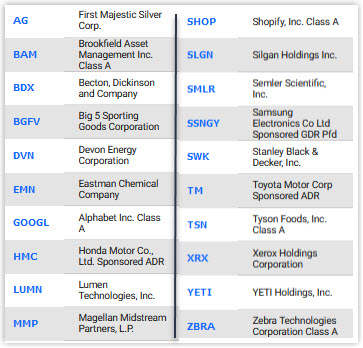

In this video I will go over these 20 stocks: Shopify (SHOP), First Majestic Silver Corp (AG), Brookfield Asset Management (BAM), Becton Dickinson & Co (BDX), Big 5 Sporting Goods Corp (BGFV), Devon Energy (DVN), Eastman Chemical (EMN), Alphabet (GOOGL), Honda Motor Co (HMC), Lumen Technologies (LUMN), Magellan Midstream Partners (MMP), Shopify (SHOP), Silgan Holdings (SLGN), Semler Scientific (SMLR), Samsung Electronics (SSNGY), Stanley Black & Decker (SWK), Toyota Motor Corp (TM) , Tyson Foods (TSN), Xerox Holdings Corp (XRX), Yeti Holdings (YETI), Zebra Technologies (ZBRA)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long GOOGL, MMP, SLGN, SWK TSN at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.