Dividend Growth HP Inc versus Hewlett Packard Enterprise

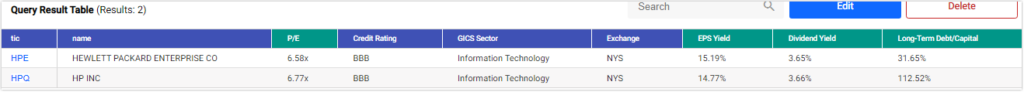

Value investing is all about finding bargains that meet your investment goals and provide a margin of safety long-term. HP Inc (HPQ) and Hewlett-Packard Enterprises (HPE) represent two dividend growth stocks with uncanny similarities regarding valuation and yield. In November 2015 Hewlett-Packard spun off Hewlett-Packard Enterprises into a separate business. Hewlett-Packard a.k.a. HP Inc. kept the iconic HPQ stock symbol and the historical stock price data. When viewed separately it seems that the spinoff unlocked shareholder value for both companies.

In this video we compare the two that currently offer almost identical dividend yields and historically low valuations. The viewer can then decide for themselves whether they buy either company or both. Regardless, we believe both entities represent good value over the long run with an adequate margin of safety. Of course, as value stocks both seem currently out of favor and could go lower. Remember: “they do not ring a bell at the top or bottom of the market.”

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long HPE at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.