Monday’s announcement that Berkshire Hathaway (BRK.A) is purchasing Lubrizol (LZ) for $135 a share is just one more example that Warren Buffett is the consummate value investor. Even after paying a $30 premium over the $105 closing price on Friday, we believe that Berkshire Hathaway is purchasing this specialty chemical company at a discount to its intrinsic value. Historically Lubrizol has traded at a price earnings ratio between 13 and 14 times earnings. If you apply these valuations to calendar year 2011 consensus $11.35 earnings estimate, Lubrizol’s calculated intrinsic value is at least $145 per share. Therefore, once again Warren Buffett buys a terrific company at a bargain priceB

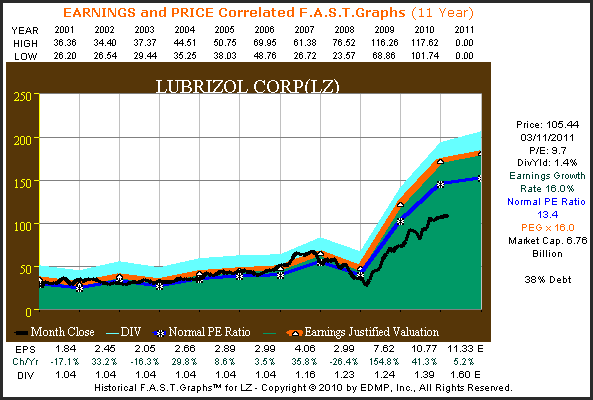

Since a picture’s worth a thousand words, let’s look at Warren Buffett’s recent purchase through the lens of our earnings and price correlated F.A.S.T. Graph™. Since calendar year 2001, Lubrizol has been growing earnings at a compounded growth rate of 16%. Notice how closely the black monthly closing price line has correlated to the orange earnings justified valuation line from calendar year 2001 to calendar year 2008. However, since strong earnings acceleration has occurred since calendar year 2009, Lubrizol shares have been trading at a discount to their historical norm. The blue line on the graph represents the calculated normal price earnings ratio of 13.4. (For a more detailed review of Lubrizol by the numbers follow this link for a short F.A.S.T. Graphs™ Alive Video.)

Consequently, it is visually clear that Lubrizol has traded between 13 to 16 times earnings until recently. What is ironic, and even illogical about this market behavior, is how the price-to-earnings ratio has actually fallen precisely at the same time that earnings have accelerated. This type of irrational behavior apparently did not go unnoticed by Berkshire Hathaway and their venerable value investor Warren Buffett. With Lubrizol trading at less than 10 times earnings, the margin of safety was large enough to allow Berkshire Hathaway to pay a premium to purchase the whole company while still acquiring a bargain in the process.

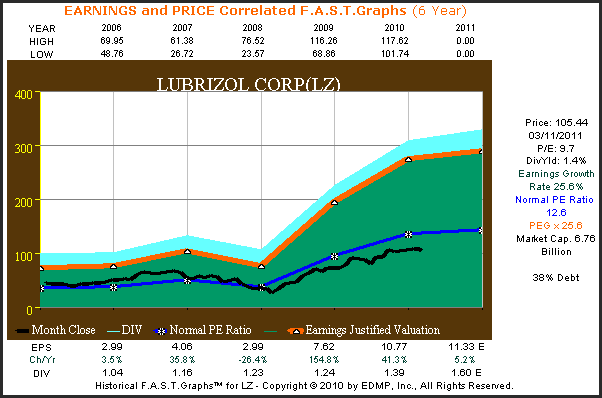

When you look at Lubrizol over the past five years, (since calendar year 2006) two interesting things become very apparent. First, you can see that Lubrizol’s earnings growth has accelerated to over 25% per annum which is historically very high for this company. Second, we see that the price earnings ratio of approximately 12.6 results from a higher average in 2006, 2007 and 2008, blended with a lower multiple in 2009, 2010 and thus far in 2011. To restate what has already been said, it seems strange that the price earnings ratio is lower during the period when earnings growth is higher. Warren Buffett apparently recognized the folly in this valuation.

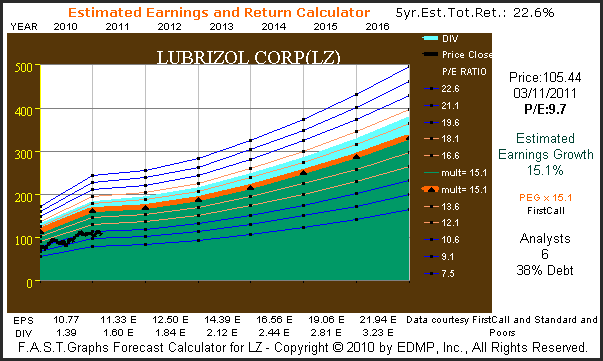

To further illustrate what we believe to be an incredible opportunity that Warren Buffett and Berkshire Hathaway exploited, let’s look at the consensus five-year earnings forecast for Lubrizol. According to six analysts reporting to first call, the consensus five-year estimated earnings growth rate is 15.1% per annum. If these earnings manifest as believed and you apply historically normal valuations to them, you will discover that even at $135 per share Berkshire Hathaway is buying Lubrizol at a bargain.

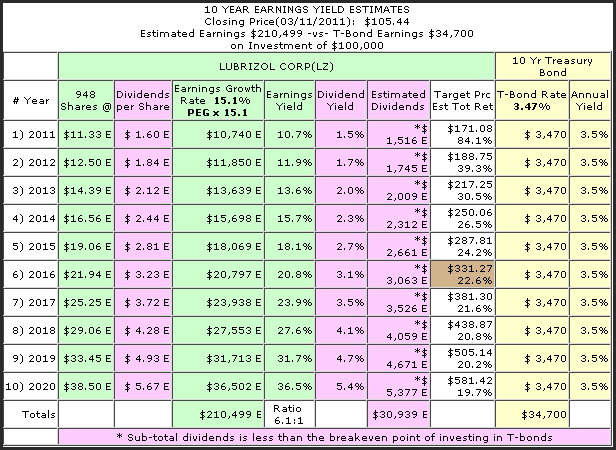

Another way to look at this, is to evaluate Lubrizol’s earnings yield at its closing price of $105.44 on Friday, March 11, 2011. Based on the consensus earnings estimate for 2011 of $11.33, Lubrizol could have been purchased with an initial earnings yield of 10.7%. The following F.A.S.T. Graphs™ earnings yield estimator illustrates the potential opportunity this represents assuming that the company traded at a fair value PE ratio of approximately 15. The brown box illustrated in the table below illustrates the potential future return that this company offered at its $105.44 price. Please note, that these numbers are mere mathematical calculations based on the consensus estimates of the six analysts reporting to FirstCall.

Summary and Conclusions

We believe that the evidence is quite clear that Berkshire Hathaway, Warren Buffett and his partner Charlie Munger understand a bargain when they see it. We believe that current market anomalies presented an opportunity for Berkshire Hathaway to purchase an excellent company at a very attractive valuation. Although this presentation was based solely on the numbers as they related to fundamentals (earnings), a closer scrutiny of Lubrizol indicates a strong and healthy company on the rise.

Lubrizol is currently generating very strong cash flows, is flush with cash and generates very strong returns on capital and equity. Ironically, much of Lubrizol’s recent growth can be attributed to acquisitions that the company was making in 2007 and 2008. However, since they were trading at less than 10 times earnings they were very vulnerable to be acquired themselves. In the final analysis, we believe that this company will fit very nicely in the Berkshire Hathaway stable of excellent companies producing strong cash flows that will further feed the Berkshire Hathaway juggernaut.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.