Introduction

“Price Is What You Pay. Value Is What You Get.”

The venerable investor Warren Buffett has a real knack of putting complex concepts and ideas into simple and easily understood terms. In my opinion, his quote, “Price is what you pay. Value is what you get” is one of the more profound and important statements he has ever uttered. If truly understood, these simple words represent perhaps some of the most important bits of investment wisdom that an investor could ever receive. Therefore, stated succinctly, the answer to the question when to buy is simply when you are reasonably certain that the company’s stock can be purchased at a sound valuation.

This concept of value represents the key to receiving the full benefit that these wise words provide. Knowing the specific price that you paid is simple and straightforward. And, although many have an intuitive understanding of value, its deeper meaning is often only vaguely comprehended. Anyone who has truly made the effort to study Warren Buffett’s investment philosophy understands that receiving value on the money he invests is of high importance to him.

So how do you know, when buying a stock, if you’re getting value or not for your money? I contend that the answer lies in the amount of cash flow (earnings) that the business you purchase is currently generating on your behalf. And regardless of how much cash flow the business is generating for you, its value to you will be greatly impacted by the price you pay to obtain it. If you pay too much you get very little value, but if you pay too little then the value you receive is greatly increased.

Therefore, if value is what you’re looking for, then it’s important that your attention be placed on the current cash flows that the business is producing. Unfortunately, few investors possess the presence of mind to focus on this critical element. Instead, investor attention is more commonly and intensely placed on stock price and its movement. A rising stock price is usually considered to be good, and a falling stock price considered bad.

Another investing great offered his view on this important point: “Just because you buy a stock and it goes up does not mean you are right. Just because you buy a stock and it goes down does not mean you are wrong.” Peter Lynch ‘One Up On Wall Street’

Just like the Warren Buffett quote that this article is based on, Peter Lynch’s quote is also based on the principle of sound valuation. The point is that a rising stock may be dangerously overvalued, while the falling stock price may indicate that the company is becoming a rare opportunity on sale.

Knowing the difference will materially impact not only the long-term rate of return the investor receives, but perhaps more importantly, the risk they take to get it. As I will illustrate later in Part 3 of this series, you can dramatically overpay for even the best company. Because, it is a truism, that the stock market can and will grossly misappraise a security from time to time – over or under.

From what has been said so far, it should be clear that in order to receive value, you must know how to calculate value. Then, and only then, can you be reasonably certain that you’re investing in a stock and receiving value for the price you pay. However, there is an important caveat that needs to be introduced.

Just because you buy a stock at value doesn’t necessarily mean that you will receive a high return. This is because value, although an important one, is only one component of future return. Another important component is the earnings and/or cash flows growth rate.

To clarify, you can buy a slow-growing company at sound valuation and even at the same valuation as a faster growing company, while still earning only a modest rate of return. In fact, it could be argued that only being willing to invest at sound valuation is more critical for a slow grower than it is for a faster grower.

The rationale here is that there is very little margin for error when investing in a low growth security. Therefore, it’s even more imperative that you get valuation correct. This may be one of the most confusing aspects of valuation, or value, that I will attempt to elaborate.

The Foundational Principles of Value

The principles that valuation is based on can be represented mathematically. However, in my first article in this series, “Answering the Important Questions: When to Buy or When to Sell a Stock,” I promised that I would not bore the reader with complex mathematical formulas. Instead, my objective is to provide logical explanations of value that represent its essence.

Therefore, I believe the reader will be presented with a more practical and useful understanding of the principle called “value.” In order to receive value when you buy a stock, you must be careful that you are only paying a price that represents sound valuation.

Furthermore, the terms value and valuation, though not synonymous, are very closely related. I am going to do my best to illustrate that the investor can only get value when buying a stock if they apply the discipline of sound valuation when they do.

In other words, when the price you pay is at a level that equals sound valuation, then good value is what you will receive. As previously suggested, if you overpay your value will be less, and if you’re fortunate enough to buy on the cheap, your value will be enhanced. However, value is a measure of soundness and prudence. Consequently, it does not logically follow that investing in a stock at value will generate higher returns. Present value can be similar or even the same for both a fast-growing stock as well as a slower-growing stock. On the other hand, the future value will be much higher with the faster-growing stock. I will elaborate later.

How Do You Value Zero Growth?

Let’s start by looking at sound valuation from the perspective of minimum to maximum levels based on rates of growth. The reader should understand that much of what I will present next represents an overly-simplistic view of valuation. However, I believe that this is the best way to lay a sound foundation of understanding of this important investing principle.

There will be subtle calibrations that investors need to apply when making investments in real world situations. On the other hand, the core principle will aptly apply and hold true. Let’s initially look at how you would value a future stream of income that doesn’t grow. A 10-year treasury bond would represent a good proxy to illustrate this principle. The interest rate is fixed and guaranteed, but it does not grow.

Common sense and logic would dictate that you would never be able buy a treasury bond at one time its interest. In other words, a stream of income (especially a predictable one) has a value that is a multiple of its annual income stream. In order to calculate current valuation, you simply divide the interest rate it pays into its price. With 10-year treasuries yielding approximately 1.78 % today, you divide 1.78 (the rate) into 100 (the price) and discover that it is selling at approximately 56 times interest.

Historically, this is a very high price which means that yields are also historically low. Therefore, people, perhaps traumatized by the great recession that are buying treasury bonds today, are willing to pay the high price for the safety they perceive they are receiving. Under more normal levels of interest rates, 10-year treasury bonds have more typically been offered at yields of 6% to 8%. Do the division and this calculates to valuations of approximately 12 to 17 times interest.

Common stocks are certainly not as safe as treasury bonds; however, the principles behind sound valuation still apply. In other words, if a company generates an income stream, even if it doesn’t grow, it will have value that is greater than its annual rate. Otherwise, this no growth investment would be generating cash on cash returns of 100%. Clearly, this would be illogical. Consequently, just like a treasury bond trades at a multiple of interest, a common stock will trade at a multiple of its income stream, which is generally represented as earnings.

The reason I started with looking at a safe, but no growth fixed income vehicle was to establish the minimum foundation of valuation. Historically, the average price earnings ratio that has been applied to the average company (the S&P 500) for the past 80 years has been 15 (something more like 14 to 17). In order to keep my promise of keeping it simple, I merely point out that this valuation relates to normal fixed income yields of 6% to 8% as discussed above.

Most importantly, this 15 multiple should be thought of as a barometer or perhaps a valuation reference used as the starting point or baseline for valuation calculations and not an absolute number. Remember, calculating intrinsic value cannot be done with perfect precision, only within a reasonable range based on sound fundamental values. The problem is that the dynamic of time is constantly adjusting the intrinsic value. However, these adjustments are typically minor and incremental. Consequently, as Warren Buffett once so aptly put it, “it is better to be approximately right, than precisely wrong.”

Present Value Versus Future Value

My personal experience suggests that one of the most difficult aspects of valuation for investors to accept or embrace is the distinction between present value versus future value. Conceptually, this might be analogous to the old adage: “one in the hand is worth more than two in the bush.” What confuses investors is how two very different companies with dramatically different growth rates can command a similar current P/E ratio (present value). The clarity comes with recognizing and understanding the distinction between present value versus future value.

As I illustrated in the previous section, even a no growth investment is worth a multiple of its annual income stream. However, when investors understand what those multiples represent, they can immediately sense the level of value – or lack thereof – that the multiple implies. For example, the fact that a current 10 year treasury bond is selling at 56 times interest immediately tells me that the 10 year treasury is extremely expensive. Of course, that same message is also reflected by the abnormally low current yield.

Moreover, the interest that a bond pays also represents the long-term return I will earn in nominal dollars if held to maturity. To me, earning 1.78% over a 10 year period that is almost certain to be ravaged by inflation simply does not interest me as a rational investor. Nevertheless, it is what it is, but I do not have to accept it or invest in it. Instead, I can choose to (in theory at least) take on more risk by investing in dividend paying stocks.

However, if I do choose to invest in stocks, I should apply the same rational thought process that I did when I made the decision stated above about the 10 year treasury bond. From this perspective, the P/E ratio of a stock represents the earnings yield that the common stock is offering me. Earnings yield is calculated as the inverse of the P/E ratio or the E/P ratio. A 15 P/E ratio, which I suggested is a rational baseline valuation reference, is equal to an earnings yield of 6.67% rounded. To me, that represents a minimum threshold that I as a rational investor might be willing to accept. This is especially relevant given the associated risk. Of course, it goes without saying that a higher earnings yield would be better. Therefore, I consider the 15 P/E ratio a minimum threshold, not the ideal valuation level.

Furthermore, I consider this kind of analysis common sense and practical in contrast to what is currently taught in academia. Simply stated, I judge value based on what the cash flows that the business is generating are providing me as a return on my investment. This is not simply highbrow academic theory, instead, it is practical real-world common sense-based calculations. At the end of the day, the value of the business is determined by how much return the business’ cash flows (earnings) are generating on my behalf as an owner/shareholder.

How Do You Account for P/E Ratios Below 15?

Anytime you come across a company whose price earnings ratio is less than 15, which I have attempted to establish as a foundational P/E ratio with this article, it’s usually associated with uncertainty. Markets (investors) do not like uncertainty. Yet, uncertainty is a reality when attempting to forecast future results. As a result, a current P/E ratio below 15 might imply a concern that future earnings might be weaker than current levels. Moreover, a low P/E ratio might also imply that investors have a jaundice view of the quality of the company or its future business prospects.

On the other hand, a low P/E ratio might simply imply a general level of fear. Also, a P/E ratio below 15 may just be an example of the market mispricing the company as I pointed out earlier in this article.

For example, let’s assume you buy a dollar’s worth of earnings today and pay $15, or a P/E ratio of 15 to buy them. One year later, the dollar’s worth of earnings you paid $15 for today has fallen to only $.50 worth of earnings. Therefore, you have paid a forward price earnings ratio of 30, or twice as much to buy these future earnings. Consequently, the market may be acting as a discounting mechanism or as suggested just mispricing the company.

Real-world Examples

Theory is fine, but for me to embrace a theory, it must prove itself under real-world conditions. In order to test the valuation theories I have presented within this article, I offer the following examples of two dividend growth stocks where the market has applied the 15-ish fair value P/E ratio multiple that I presented to each, even though they have produced significantly different long-term historical growth rates. Nevertheless, this begs the question:

Why have these two stocks historically commanded approximately the same true worth price earnings ratio?

Even with such wide discrepancies in growth, each indicate an implied fair value P/E ratio of 15.

The following price and earnings correlated FAST Graphs illustrate this point. However, note that even though their intrinsic values are represented to be similar, the rates of return their shareholders have received have differed greatly. As previously stated, fair valuation does not imply a high rate of return, instead, it signifies soundness and prudence. These are just two examples that illustrate this point.

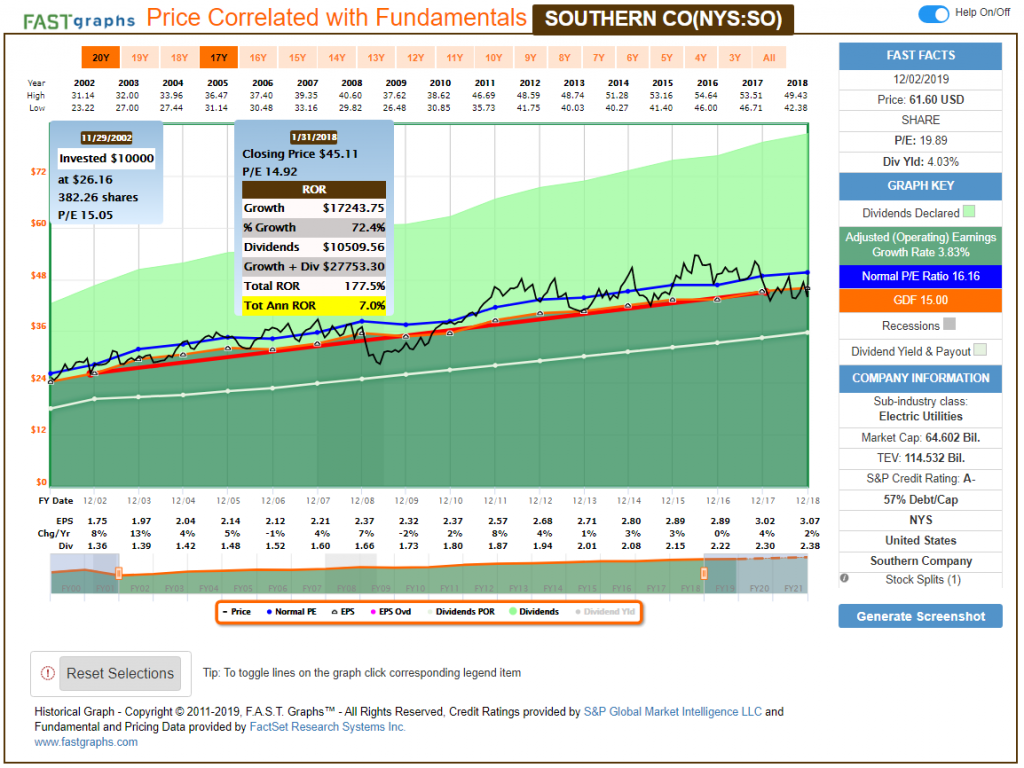

Southern Company (SO) is a high-quality regulated utility that has produced a consistent but below average rate of earnings growth of 3.83%. Nevertheless, the stock has clearly commanded a valuation of P/E ratios between 15 to 16 with occasional outlier levels.

Importantly, note the pop-ups at the upper left-hand corner of the graph that calculate how Southern Company’s shareholders earned a rate of return that was commensurate with the company’s earnings achievements.

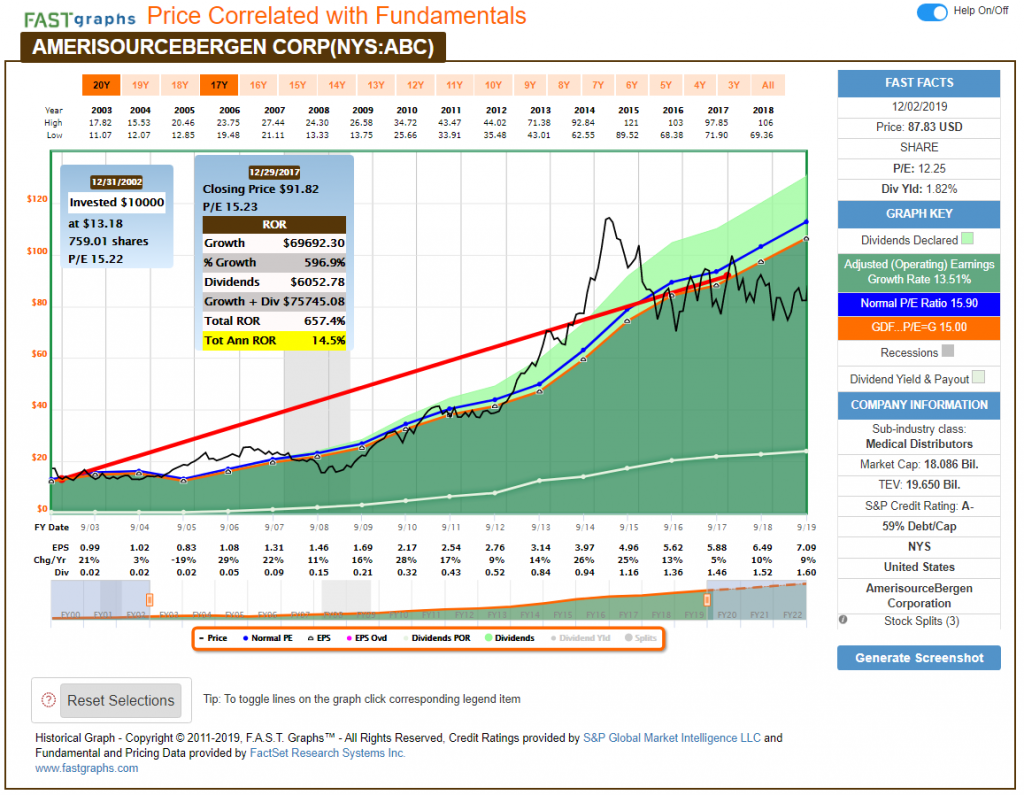

With my second example utilizing AmerisourceBergen Corp. (ABC) we see a much faster growing company that has historically commanded a similar 15 as fair value P/E ratio. However, in this case we see significantly higher rates of return enjoyed by shareholders as a result of this faster growth. In the following analyze out loud video, I will elaborate more fully to include the significant effects that undervaluation or overvaluation will have on performance.

FAST Graphs Analyze Out Loud Video Elaborating On Price Versus Value

Conclusions

In this Part 1 of this three-part article on value is what you get, I’ve attempted to lay the foundation of understanding how to value a common stock. So far we have looked at low to moderate earnings growth examples and commented on collapsing earnings which really have no value. In Part 3 we will look at companies that grow earnings at 15% or greater as we investigate the nuances of valuing this faster growth.

In both Part 1 and Part 2, I have primarily focused on historical evidence in order to establish the validity of my thesis. In other words, theories are fine, but need to hold up in the real world. This is the real value that historical analysis offers, the actual real world evidence that the theories hold up. In Part 3 I will change my focus and look to valuing the future. Applying the same logic that we learned from the past, should enable us to make better decisions about the future.

Disclosure: Long ABC and SO

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.