Introduction

As investors, we can learn a great deal from the past about the businesses we are contemplating investing in. However, as investors, we must also recognize that we can only truly invest in the future.

Consequently, although understanding a company’s history can help us better understand the business, our success is predicated on our ability to recognize the business’s future potential. And most importantly, we can also learn from past valuation levels, but we must calculate the present and future value of the business based on its capacity to produce a future income stream on our behalf. At its core, fair valuation is a function of discounting future earnings, cash flows and revenues back to the present value.

Therefore, if you are looking for good dividend paying stocks to add to your retirement portfolio, you might want to start out by reviewing analysts’ estimates to aid in your selection and evaluation process.

Putting Analysts’ Estimates Into Perspective

The future value (total return) of your investment will be a function of fair value and the growth the business you are selecting achieves in the future. Therefore, the key to investment success is predicated on forecasting the future growth of any business you are evaluating with as much accuracy as is possible. This is most commonly measured based on a company’s reported earnings when they file each quarterly financial statement.

However, early in this article I do want to point out that earnings, although commonly used, are only one of many other metrics where the same logic can be applied. In other words, this same need-to-accurately-forecast principle applies to cash flows, revenues, dividends and other metrics such as EBITDA, etc.

As a result, I contend that estimating future earnings growth (and/or any of the other metrics) is a major key to successful long-term stock investing. If you’re a true investor, then you are investing in the business, not the stock. Consequently, the success of the business that you invest in is going to be the primary determinant of how much money you can expect to earn on that investment.

Be a Stickler for Fair Value

Being prudent to only invest when valuation makes economic sense is the second primary determinant. Stated more directly, when you invest in a business you are buying its future earnings potential. If you invest at fair value, you will most likely participate precisely in the growth of that business over the long run. If you are lucky enough to find a business when it’s undervalued, you will position yourself to earn more than the business generates, and vice versa.

To my way of thinking, the only logical reason I would ever want to own any stock (business) is because I believe that the company is a profitable enterprise. But not just in the past, or the present, but most importantly in the future. After all, and as I previously stated, future profits will be the source of any long-term return expectations I might have. Moreover, the growth of those profits will be a primary contributor to the total annualized return I can expect the investment to produce on my behalf.

Therefore, I believe as investors, we cannot escape the obligation to forecast a business’s future growth potential, because our results depend on it. Furthermore, we should not guess, nor should we simply play hunches. Instead, we must attempt to calculate reasonable probabilities based on all the information that we can assemble.

Then we should apply analytical methods based upon our earnings driven rationale that provide us reasons to believe that the relationships producing earnings growth will persist in the future. In other words, we must strive to forecast future earnings as accurately as we possibly can. On the other hand, we should simultaneously realize that perfection is not to be expected.

As an aside, there are many who criticize or even claim that we should eschew utilizing forward earnings forecasts when trying to determine fair value, or even when trying to decide what stock to own. I find these positions rather bizarre. I cannot think of any logical reason why anyone would invest in a business, unless they had a reasonable expectation of that business’s ability to generate future profits. Since I am confident that both capital appreciation and dividend income will be a function of the company’s future earnings power, estimating future earnings must be the essential element of long-term success.

The Selection Dilemma

But here is the dilemma. With all the thousands of companies to choose from, how can I forecast future earnings accurately enough in order to pick the stocks that might best meet my goals and objectives? I believe the obvious answer is by initially reviewing and considering the consensus estimates of leading analysts following a given company. These estimates are readily available and provided by earnings estimate aggregators such as FactSet, Standard & Poor’s Capital IQ, Zacks, Thomson Reuters IBES (Institutional Brokers Estimator Service) and others. Moreover, earnings estimates can also be found on most major financial websites and blogs.

Forecasting is Not A Game of Perfect Nor Does It Need To Be

Admittedly, consensus estimates may not be perfect; in fact, I would almost guarantee that many estimates will be wrong. On the other hand, I also believe that consensus estimates are generally accurate enough to be of value, especially for stock screening purposes. And more importantly, the closer to current time the estimate that you’re relying on is (this year or next year’s estimate), the more likely it is that they will be accurate enough to be of value.

At this point, I am sure many readers skeptical of analysts’ estimates will cite numerous studies by academics suggesting that analysts’ estimates are not accurate enough to be of value. Perhaps the most famous study on the accuracy of earnings estimates is the McKinsey study. Frankly, I have read the McKinsey study, and most other similar studies, and found that they provide little evidence to deter me from relying on and benefiting from analysts’ estimates.

For example, one prominent study suggests that analysts’ estimates are often off by factors of 12% or more. Later in this report, I will illustrate why I believe that margins of error at that magnitude are not relevant deterrents against relying on analysts’ estimates. This is especially true if forward earnings estimates are utilized and viewed correctly.

Consensus Earnings Estimates Accuracy

Perhaps most importantly, we must ask ourselves the question: just how accurate do analysts’ estimates need to be to be of real value? I believe the answer to this important question is – within a reasonable range of probability. Since forecasting is all about the future, and much of the future is an unknown, we must accept the fact that estimates will contain a level of imprecision. Therefore, we should expect discrepancies to manifest when our forecast eventually turns to actual reality (reported earnings).

Furthermore, I believe it would be naïve to expect analysts’ estimates, or even consensus estimates, to be perfect. There are a lot of unknown variables in the future that could affect the ultimate results. Furthermore, many companies, especially multinationals with numerous divisions and diverse businesses, are complex enterprises with a lot of moving parts. Therefore, and once again, I believe that the best that a rational person can hope for is that estimates fall within a reasonable range of probability and accuracy.

Moreover, I have always believed in running the numbers out to their logical conclusions. In other words, let’s calculate and think through what an earnings miss might mean in numerical terms. For example, a very common miss that the media seems to take great glee and relish in reporting, is a plus or minus by a penny. In other words, XYZ Company reported earnings today that missed analysts’ expectations by one cent. We’ve all seen the stock price of the company reporting such a miss often fall by ridiculous percentages of 5%, 10%, even 20% or more.

However, let’s do a simple calculation and apply some basic logic to what a one penny miss might mathematically mean. If we assume that the normal P/E ratio of the average company is 15, then a company that delivered one penny less than expected should only have a market value that is $.15 less than what our original estimate indicated. For a very fast-growing company, let’s say one growing by 20%, a one penny miss might require a discount of $.20 (i.e. P/E 20 x one penny). My point being; that a one penny earnings miss does not really amount to very much in the long-term scheme of things. Moreover, consider that this same math applies whether the earnings miss is plus a penny, or minus a penny.

As an aside, based on my own, albeit anecdotal experience, there tend to be more earnings misses on the plus side than there are on the negative side. I believe this is because a significant portion of the ultimate estimate that an analyst makes is significantly based on guidance from the company itself. I believe that prudent (smart) management teams are more likely to guide lower and therefore exceed expectations, than the other way around. This presents the argument that relying on the forward earnings estimates of analysts may be a very conservative way to base stock investing decisions on.

What If Calculations – Running The Numbers To Their Logical Conclusions

But with all the above said, analysts’ estimates provide an important metric that investors can utilize in order to make sound and smart long-term stock investing decisions. They will rarely be perfect, but in most cases, they will be accurate enough to be a useful barometer that investors can rely upon to make reasonable and/or prudent long-term stock investment decisions.

I am going to focus on how important and highly correlated the earnings and price relationship is. In other words, the relationship between a company’s stock price and its earnings achievements are highly correlated over the long run. Therefore, it only logically follows that future investment returns will also be a function of future earnings achievements. Consequently, I confidently state that forecasting future earnings is the key to long-term investing success.

Furthermore, I want to restate and acknowledge that I believe that investors cannot escape the obligation to forecast–our results depend upon it. However, we should not just guess, nor should we merely play hunches. Forecasting should be approached as analytically and even as scientifically as possible.

Our goal is to calculate reasonable probabilities based on all information that we can assemble. We should then apply analytical methods that are employed based upon our underlying earnings-driven rationale. The endgame is providing us reasons to believe that the relationships producing earnings growth in the past will persist in the future. Maybe not at the precise historical rate, but at least at a rate that should compensate us for the risk we are assuming.

FAST Graph Analyze Out Loud Video: Real-life Examples From Past Articles

On March 2013, I wrote a similar article on the importance of forecasting earnings as the key to investment success. In this previous article I ran through a few sample companies with varying historical growth rates where I presented FAST Graphs forecasting calculators going out to 2018. In order to illustrate the magnitude, or lack thereof, of how accurate analysts’ estimates have been on these specific companies, I have included updated graphs with actuals.

I acknowledge that skeptics could point out that my sample size is too small here to be relevant. I accept that as truth. However, I will simply state that over my 50 year career I have examined thousands of similar examples with only rare exceptions showing up. Therefore, it is not the specifics of the examples I am utilizing that is important. Instead, it is the principal that a reasonable forecast of future business results is vitally important to achieving our financial goals.

Furthermore, the companies I utilized in these examples were and are only offered because they represent low growth, moderate growth and fast growth examples. To be clear, I am not recommending or building a case for investment, or against investment, in any of these samples. Instead, I am utilizing them to provide some mathematical realities of what earnings estimates are mathematically speaking all about.

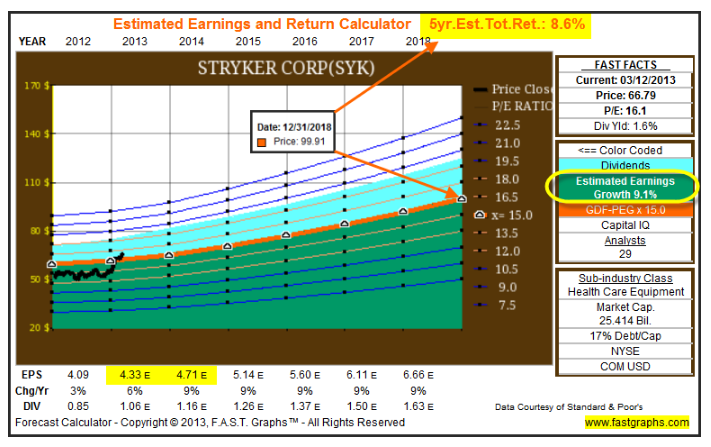

Stryker Corp. Moderate Growth

On March 12, 2013 my article included a forecasting calculator for Stryker Corp. (SYK) going out to 2018 that had forecast future earnings growth of 9.1%. Based on that growth forecast, Stryker Corp. would earn $6.66 by year-end 2018. (Note: that this was a 3 to 5 year trend line forecast and not specific for each included year).

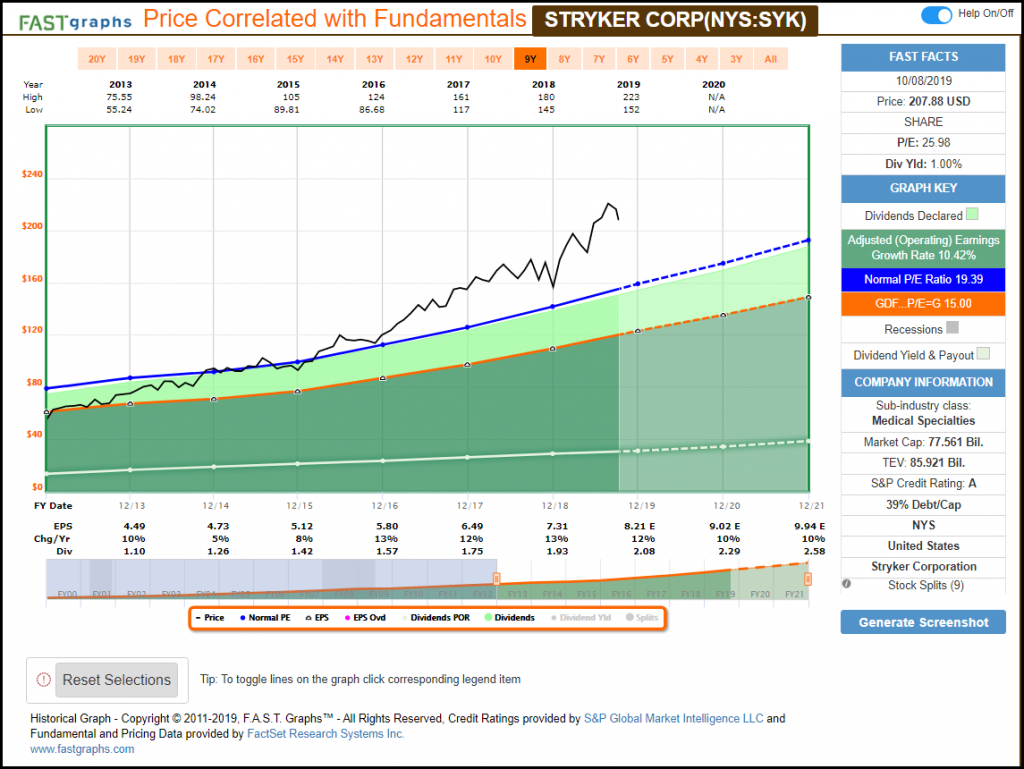

As the following current FAST Graph on Stryker Corp. illustrates, the company achieved earnings growth of 10.42% instead of 9.1%, and earnings-per-share for 2018 were $7.31 or higher than the $6.66 forecast. However, I also want the reader to recognize that both the growth rate in the actual earnings achievement were within a reasonable range of what the analysts originally forecast. Furthermore, this is one example where the estimates proved to be conservative as I postulated earlier.

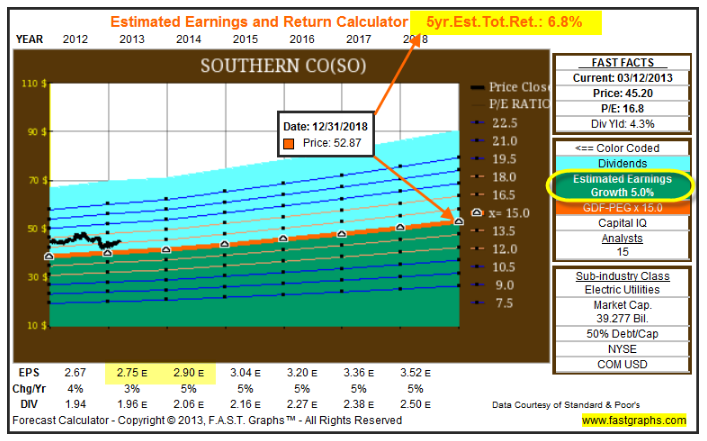

Southern Company Low Growth

The forecast calculator in my 2013 article for low growth Southern Company (SO) expected 5% growth through year-end 2018. Running the numbers out to their logical conclusion, this would have indicated an annualized rate of return of 6.8%.

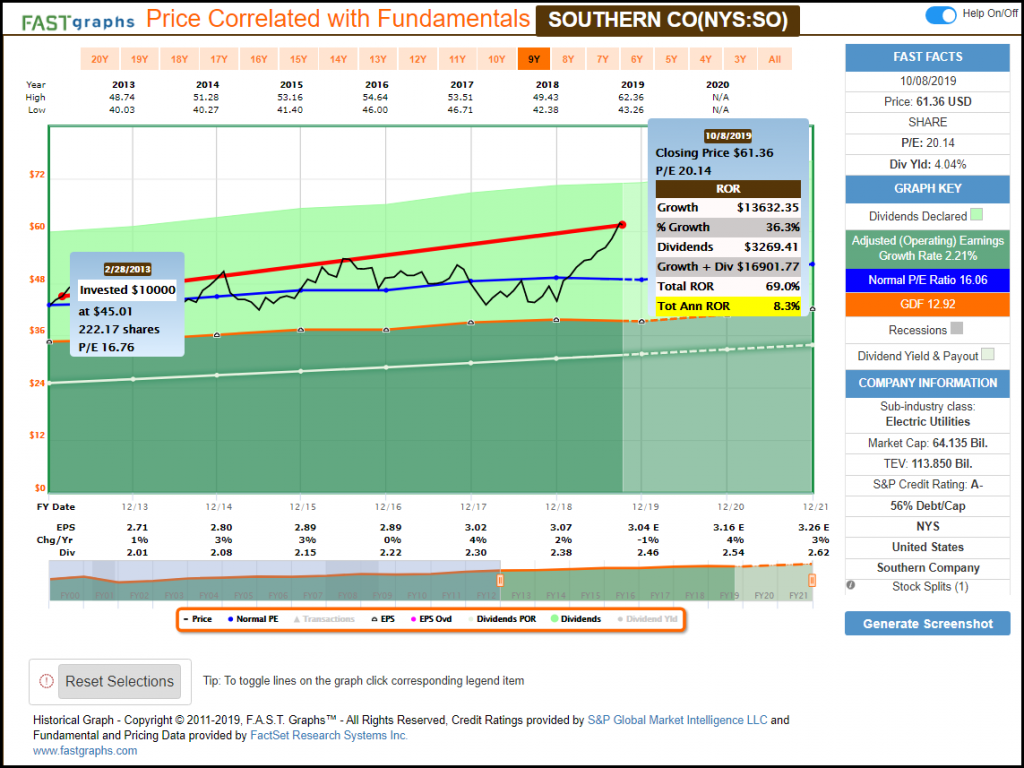

Interestingly, Southern Company disappointed based on earnings growth of 2.21% actual versus the 5% forecast. However, Mr. Market inexplicably has placed an excessively high valuation on the stock. Consequently, Southern Company shareholders have actually enjoyed a rate of return in excess of what was forecast and calculated in 2013.

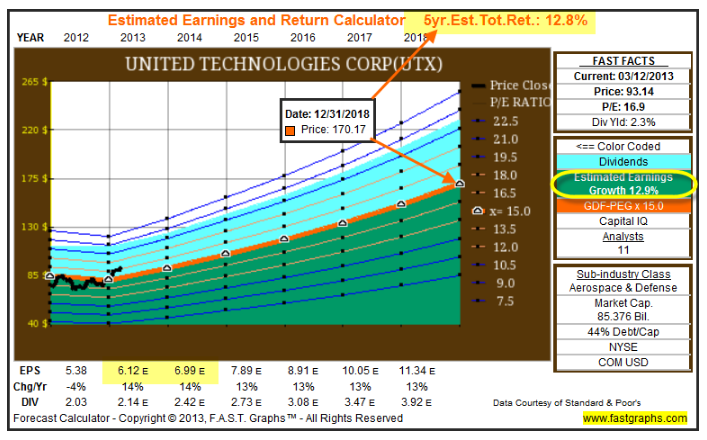

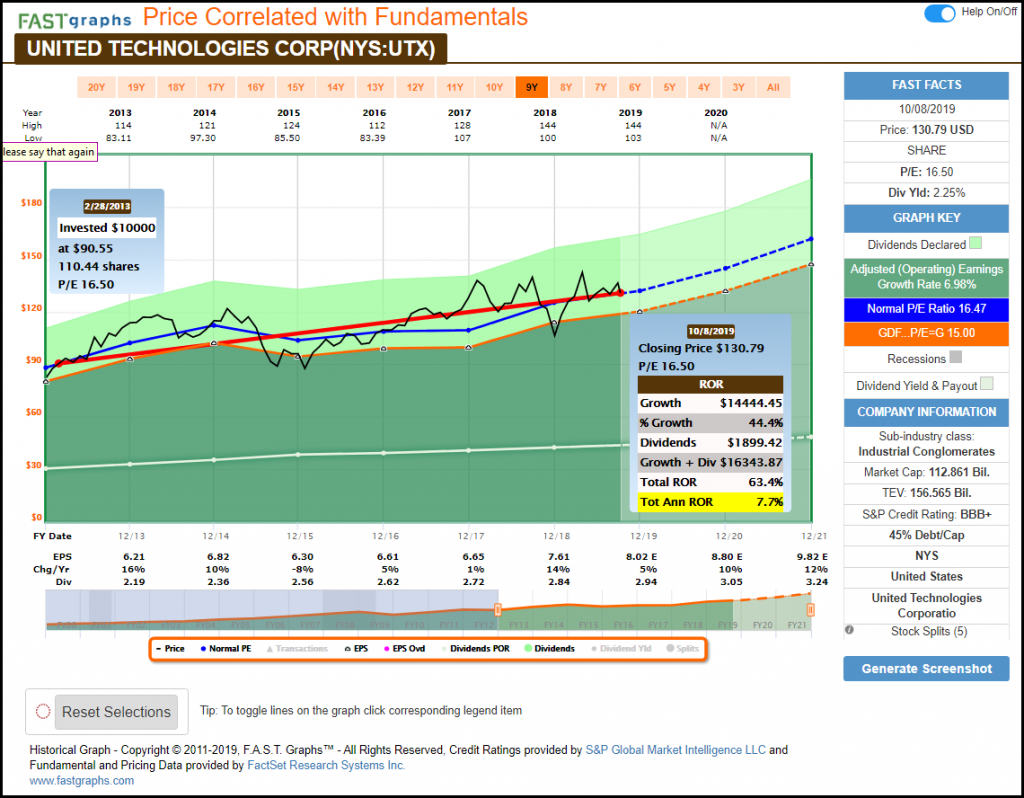

United Technologies Moderate Growth Disappointing Results

On March 2013 analysts had a very rosy and optimistic forecasts for United Technologies’ (UTX) growth out to 2018. Consequently, the expected future total return was very high at 12.8%.

Unfortunately, United Technologies disappointed where earnings only grew at 6.98% instead of the 12.9% forecast. However, I contend there are two things that the reader should note about this example. Number 1, the company did grow earnings at a respectable rate of approximately 7% per annum even though they disappointed. As a result, shareholders enjoyed a respectable 7.7% annualized rate of return which included dividend growth for each year.

Although this company did not meet their projections arguably even within a reasonable range of probability, the company did grow, and it did generate a positive return for its shareholders. However, the primary takeaway here is that earnings growth did correlate with shareholder returns even though they disappointed.

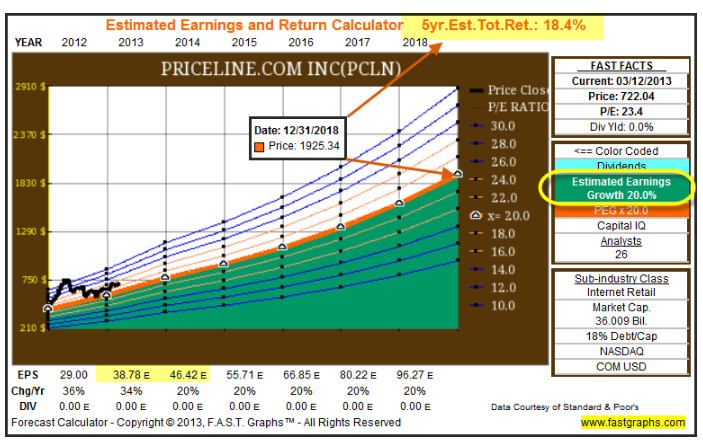

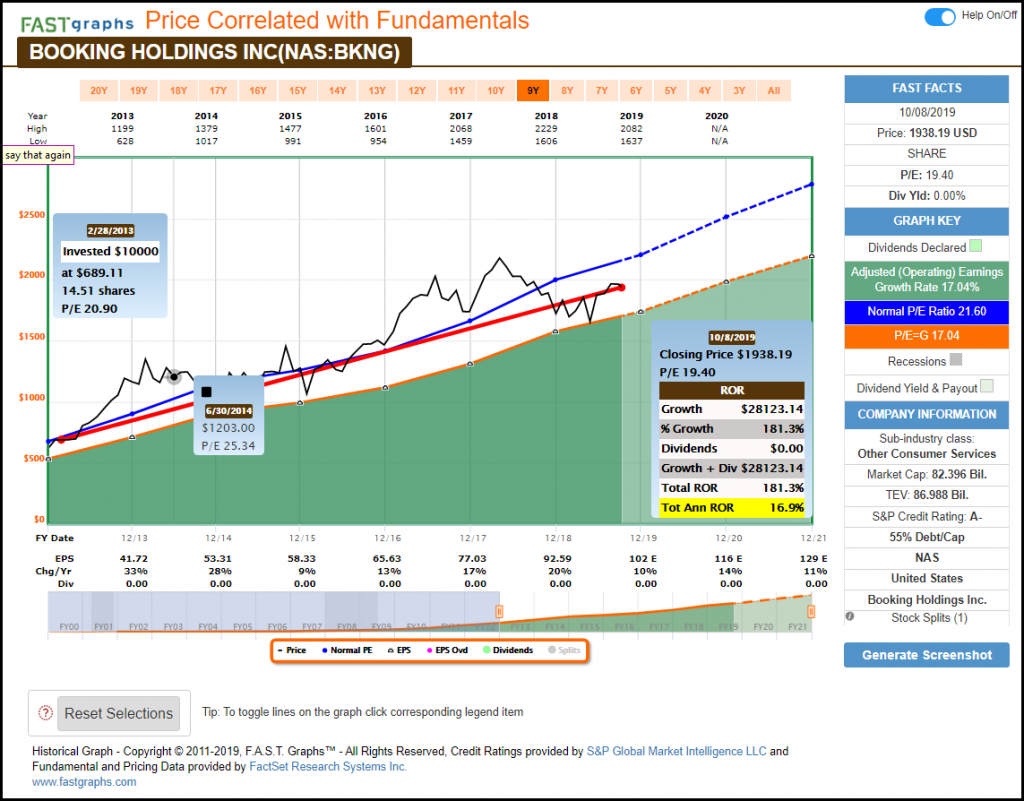

Priceline then – name change to – Booking Holdings Inc. now

In the article I published on March 2013 I included a forecast calculator for the historically fast-growing company then known as Priceline. However, the company has changed and evolved and is now known as Booking Holdings Inc (BKNG). Nevertheless, earnings growth was forecast to average 20% out to 2018 and shareholder returns were expected to equal 18.4% per annum.

Admittedly, this represents a second example where estimates came in lower than analysts had forecast. However, this also represents an example where the estimates were within a reasonable range of accuracy. As seen below, the company now known as Booking Holdings Inc. did grow earnings at 17.04% per annum, and shareholders earned a very respectable 16.9% per annum rate of return instead of the 18.4% expected. Although this is a disappointment, it once again illustrates the importance of at least getting the general magnitude and trend of earnings growth correctly forecast for the future.

I presented these as examples graphically so that the reader could examine the data more carefully. However, in the following video I will delve more deeply into the importance of estimating earnings to include an analysis of analyst scorecards. Personally, I believe the video represents the most important insights into the subject matter covered in this article. Please take the time to watch it as I believe you will benefit greatly from doing so.

Summary and Conclusions

Regarding forward earnings estimates, there are a few simple points that I would like to elaborate on. First, forecasting future earnings is certainly simpler and more reliable than trying to forecast stock prices or stock markets. A quote from one of my favorite financial legends, Marty Whitman, Chairman of the Board, Third Avenue Value Fund, speaks to this point:

“I remain impressed with how much easier it is for us, and everybody else who has modicum of training, to determine what a business is worth, and what the dynamics of the business might be, compared with estimating the prices at which a non-arbitrage security will sell in near-term markets.”

Second, I believe that analysts’ estimates tend to be under-estimated more often than over-estimated. Furthermore, I believe the reason for this is that analysts derive most of their estimate based on guidance from the management of the companies they are providing estimates for. Commonsense says that companies are more prone to under-estimate their guidance so they can beat consensus and see their stock price rise, than to miss estimates and see their price fall.

Additionally, estimates need only fall within a reasonable range of accuracy in order to be of great value regarding making long-term investment decisions. As I illustrated with my examples above, reasonable deviations will not really have a great enough impact that is strong enough to alter an investment decision. In this context, estimates should be used as guides, and I suggest that investors always have, and calculate a best case, moderate case and worst case scenario.

But perhaps most importantly of all, investors should consider all the available estimates that analysts provide. However, their greater emphasis should be placed upon near-term estimates over the longer-term estimates. And, it is imperative that estimates are continuously monitored and updated. There is never a substitute for comprehensive due diligence.

Disclosure: Long SYK,SO,UTX

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.