Introduction

The Value Beats Growth Or Vice Versa Myths

One of my greatest pet peeves as a long-time investment professional is the industries’ notion that stocks can be generally categorized into only two styles commonly referred to as growth investing or value investing. These overly-vague notions about investing in stocks can even be seen in our most prestigious financial news outlets and sites. Currently, the mantra appears to be that growth is beating value, as if there is a long-running rivalry between only these two classes of stocks.

Personally, I believe this overly-generalized type of thinking is very detrimental to investors at all levels. My primary beef is that it distracts investors from thinking about important principles of sound investing by focusing their attention on fallacious concepts. Instead of helping investors understand how rates of return on stocks are generated and where they come from, we dupe them into thinking about ambiguous concepts that are imprecisely defined. In truth, there exists a virtual infinite array of common stock types.

And more to the point, most stocks are technically growth stocks at some level. However, some stocks grow slowly while other stocks grow very fast – and literally everything in between. Moreover, even the fastest growth stock can at the same time be in value, or for that matter, be dangerously overvalued. Just because a growth stock comes into value doesn’t change its true classification. In other words, a growth stock can also at the same time be a value stock.

What I’m really suggesting is that we need to be more precise with our conceptions and understandings of how a common stock delivers returns, and where they come from. Stating vague and imprecise concepts such as “value stocks” or “growth stocks” provides little insight or understanding into how money is made in stocks.

I will conclude this introduction by pointing out that value is not an asset class, instead it is a representation of whether (or not) you are paying a fair price for an asset. As previously stated, growth stocks can also simultaneously be available at a fair value or even undervalued. At the end of the day, valuation is a measurement of the level of risk you are assuming in order to achieve a rate of return. Or as Warren Buffett once so aptly put it “Price is what you pay, value is what you get.” Even though it should go without saying, investing in any stock at a better value produces a better rate of return – and vice versa. So, let’s look at where the total returns on stocks are sourced from.

Sources of Return: First there is Growth then there are Dividends

Ultimately, the returns that a common stock delivers will be a function of how fast the business grows in conjunction with whether it pays a dividend and how fast that dividend grows. Additionally, valuation will also have an effect. Valuation can either enhance or reduce the returns that the business can generate. Higher valuations reduce returns, lower valuations enhance returns. Even though this is simple common sense, the simple concept is often overlooked or ignored by investors.

The growth rate, rate of change or velocity of growth has a significant mathematical impact on eventual rates of return. Consequently, if prudent and rational valuation principles are applied, high growth will always outperform lower growth whether high growth is impeccably valued or not. And as a further aside, whether dividends are paid or not.

As I will illustrate later, the power of compounding is a powerful force. Therefore, don’t fall into the myth that value will beat growth – or vice versa. High growth will most always win the race. The only exception will be when valuations are so extreme that they can even defeat the incredible power of compounding. Consequently, it’s implicit that investors understand, recognize and acknowledge how fast the business they are looking at is growing and whether the market is valuing it rationally or not.

Although I would acknowledge that investing in high-growth stocks is undoubtedly riskier than, for example, investing in blue-chip dividend growth stocks, their rapid growth can effectively mitigate some of the risk. Thanks to the power of compounding, the company that is growing its earnings very fast can bail investors out even if they overpay for the stock at purchase. Of course, this assumes that the company continues growing at above-average rates. And more importantly, assumes that the investor stays the course, which admittedly is an aggressive assumption.

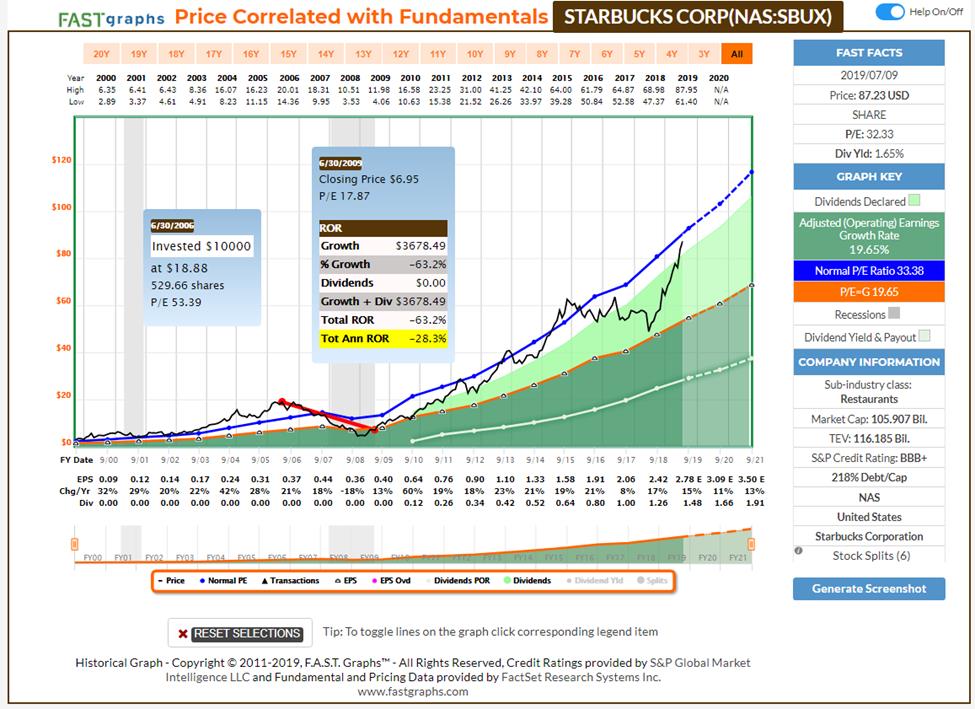

The following earnings and price correlated graph on Starbucks (SBUX) characterize a case in point. Had you invested in the company at its peak P/E ratio of 53.39 on June 30, 2006 you would have obviously suffered significant losses over the next 3 full years.

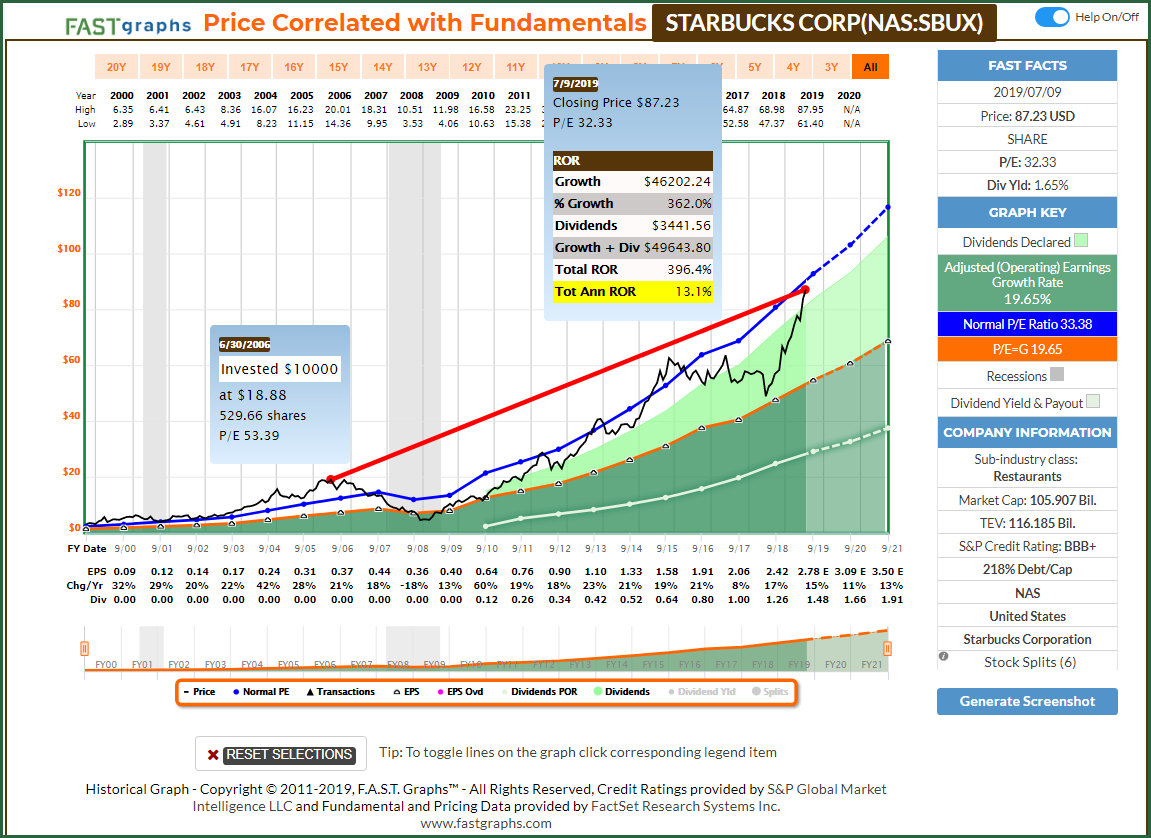

However, considering that this original irrational behavior took you into the throes of the Great Recession, and further considering that the company remained profitable, you would have made money long-term if you held onto the stock. Above-average earnings growth bailed you out even though the current P/E ratio of 32.33 is significantly below the P/E ratio you paid at original purchase.

Therefore, my definition of a high growth stock is straightforward and precise and has nothing to do with value definitionally. Conceptually, a high growth stock represents the common stock of a company whose business is consistently growing earnings and/or cash flow at a significantly above-average rate. Considering the historical average growth rate of stocks (6 to 8%), I consider a high growth stock as a company at a minimum whose earnings are consistently increasing at double-digit rates (10% or higher).

The reason I bring this up is because my experience has taught me that modern finance often holds a very cavalier or vague definition of what a growth stock is. Consequently, those engaged in the growth stock versus value stock debate will often cite studies indicating that value stocks outperform growth stocks or vice versa. However, when I have personally reviewed and analyzed many of those studies, I usually discovered that the researchers were taking great liberties with the definition of a growth stock and with their definition of what a value stock is.

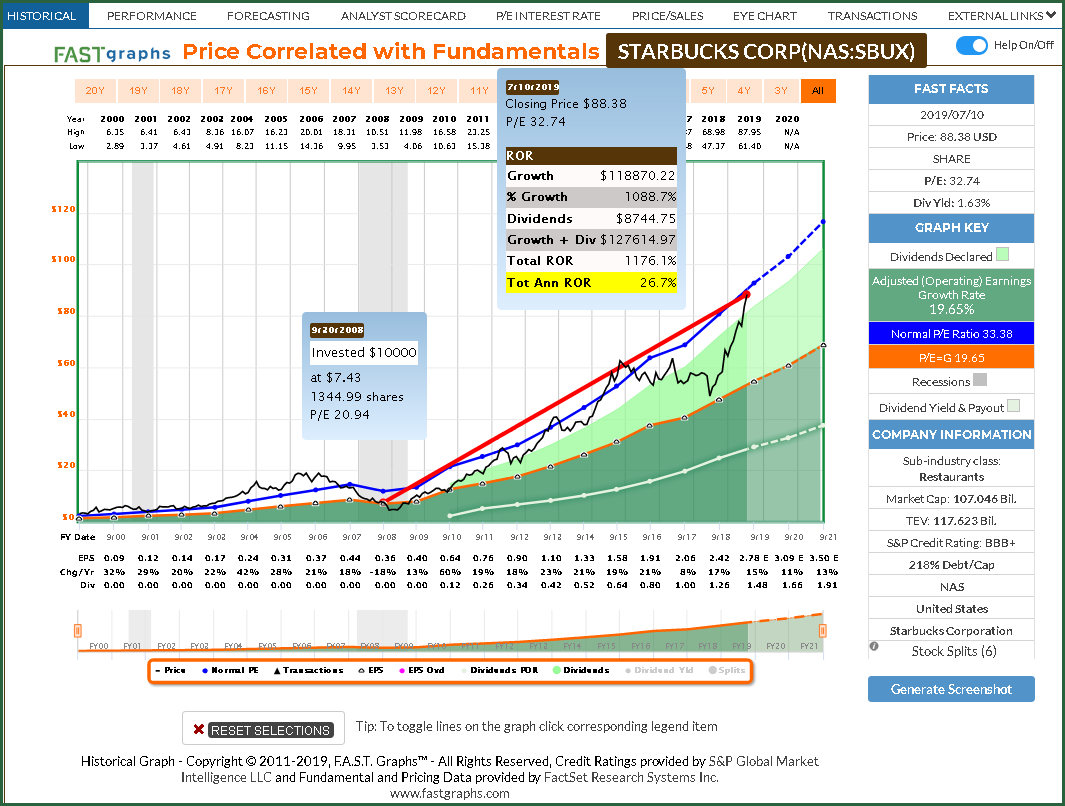

In truth, if you buy a great growth stock like Starbucks at an attractive valuation, it is simultaneously a value stock and a growth stock. But most importantly, your results are greatly enhanced while your risk is simultaneously reduced. With my final screenshot, I assume that the investor waited approximately three years in order to buy the growth stock Starbucks when it also became a value stock (GARP-growth at a reasonable price). The result is that the investor would have doubled their rate of return (26.7% versus 13.1%) which more than doubled the total dollars they would have had at the end which are also generated in three years less time.

The Power of Compounding

Compounding is a very powerful force, which over long periods of time will inevitably outperform value. And to the point of this article, is a precise consideration that should always be made when investing in common stocks. Consequently, I look at growth from the perspective of time compression instead of total rate of return generation. Thanks to the power of compounding, investing in pure growth stocks can in effect compress time. In other words, instead of taking a decade or more to double your money in a blue-chip dividend growth stock, you can double your money much quicker in a true growth stock.

To illustrate my point, I will turn to the widely recognized Rule of 72. This rule states that you can calculate the number of years it takes to double your money at a given compound return by dividing it into the number 72. I have often utilized the following illustration to demonstrate the point I am making about the power of compounding compressing time.

First, I will assume that the average person has a working lifespan of 36 years. In modern times this may be a conservative assumption, but as I will soon illustrate it facilitates the math. Next I will assume two different compound rates of return as they apply to the average common stock, and then to the pure growth stock. For the average common stock, I will assume a generous and above-average rate of return of 10% per annum. For the pure growth stock, I will assume the appropriately higher rate of return of 20% per annum. The math then looks like this:

With the average common stock, If I divide 10% into 72, I calculate that it will take 7.2 years to double my money (72/10% = 7.2 years).

With the pure growth stock, if I divide 20% into 72, I calculate it will take 3.6 years to double my money (72/20%=3.6 years).

If I apply this math to my assumed average working life of 36 years, I get the following results:

If my money doubles every 7.2 years at a 10% rate of return, I will get 5 doubles in 36 years (36/7.2=5).

If my money doubles every 3.6 years at a 20% rate of return, I will get 10 doubles in 36 years (36/3.6=10).

The net effect is that by doubling my average rate of return from 10% to 20% per annum, I do not earn two times the money by earning twice the return. Instead, I get double the doubles. Looked at from the perspective of the first $1 (dollar) invested the power of compounding (compressing time) becomes vividly clear.

Doubling my first $1 (dollar) 5 times at the 10% return results in the following: $1 doubles 5 times to $2, $4, $8, $16, and finally to $32. However, at the 20% return I get 5 additional doubles over the same 36 year timeframe as follows: $64, $128, $256, $512, $1024.

To put this into perspective, over my assumed 36 year working lifetime I earn 32 times more money by earning 20% than I would have if I earned 10% (1024/32=32). Doubling the number of doubles over the same timeframe shows the incredible power of compounding that true growth stocks are capable of offering.

The Incredible Benefits of Growth

However, at this point I would like to share some observations about investing in high growth stocks that I feel are both interesting and important. As regular readers of mine know, I am a stickler for fair valuation. Personally, I like to refrain from ever investing in any type of company at prices or valuations that I believe exceed what a company is truly worth.

On the other hand, one of the great benefits of investing in high-growth stocks is that as long as they are in a high-growth phase, you can pay more than they are worth and still make money. You can thank the power of compounding for that risk mitigation. Of course, if you find them at or below True Worth™ value, then you can make more money while simultaneously taking on less risk. Lower risk and higher return is certainly a desirable objective. However, my point here is that as long as they are growing fast, there is no price or valuation, within reason, that you could pay and not make some money. Nevertheless, the hat trick so to speak is that the company continues to grow at high rates after you purchase it. This is where the risk is with growth stocks, because achieving and maintaining high growth is both difficult and rare.

Value: A Precise Calculation Not an Opinion

Fair value or the calculation of fair value is not and should not be an opinion. Fair valuation, properly calculated, is a mathematical reality that is undeniable. Unfortunately, many investors confuse market value with fair value. In the short run, Mr. Market is liable to put any valuation on a given stock depending on its or its industries’ current popularity. Unpopular stocks obviously tend to attract low valuations, while popular stocks will attract higher valuations, at least in the short run. However, in the long run a company’s true worth or intrinsic value will inevitably manifest (reversion to the mean).

Although there are many ways to attempt to ascertain the fair value of a stock, all credible methods are based on a rational discount of future earnings or cash flows to the present value. Additionally, all credible valuation methods will calculate whether a given stock’s business potential will compensate you for the risk you are taking if everything happens as you expect.

The more common measurements depicting valuation from this perspective would be earnings yield, cash flow yield and certain calculations of normal dividend yields. The point is, true valuation calculations are not vague concepts or opinions. Instead, they are precise measurements of the company’s business potential and whether (or not) that potential will adequately reward you as a stakeholder.

Consequently, I also vehemently argue that overvaluation, more precisely paying more for a stock than it is truly worth, is an obvious mistake that can or should be avoided. Investing is hard enough, and some mistakes are certainly unavoidable. Therefore, we should as prudent investors have the presence of mind to evade mistakes such as overvaluation that are clearly avoidable.

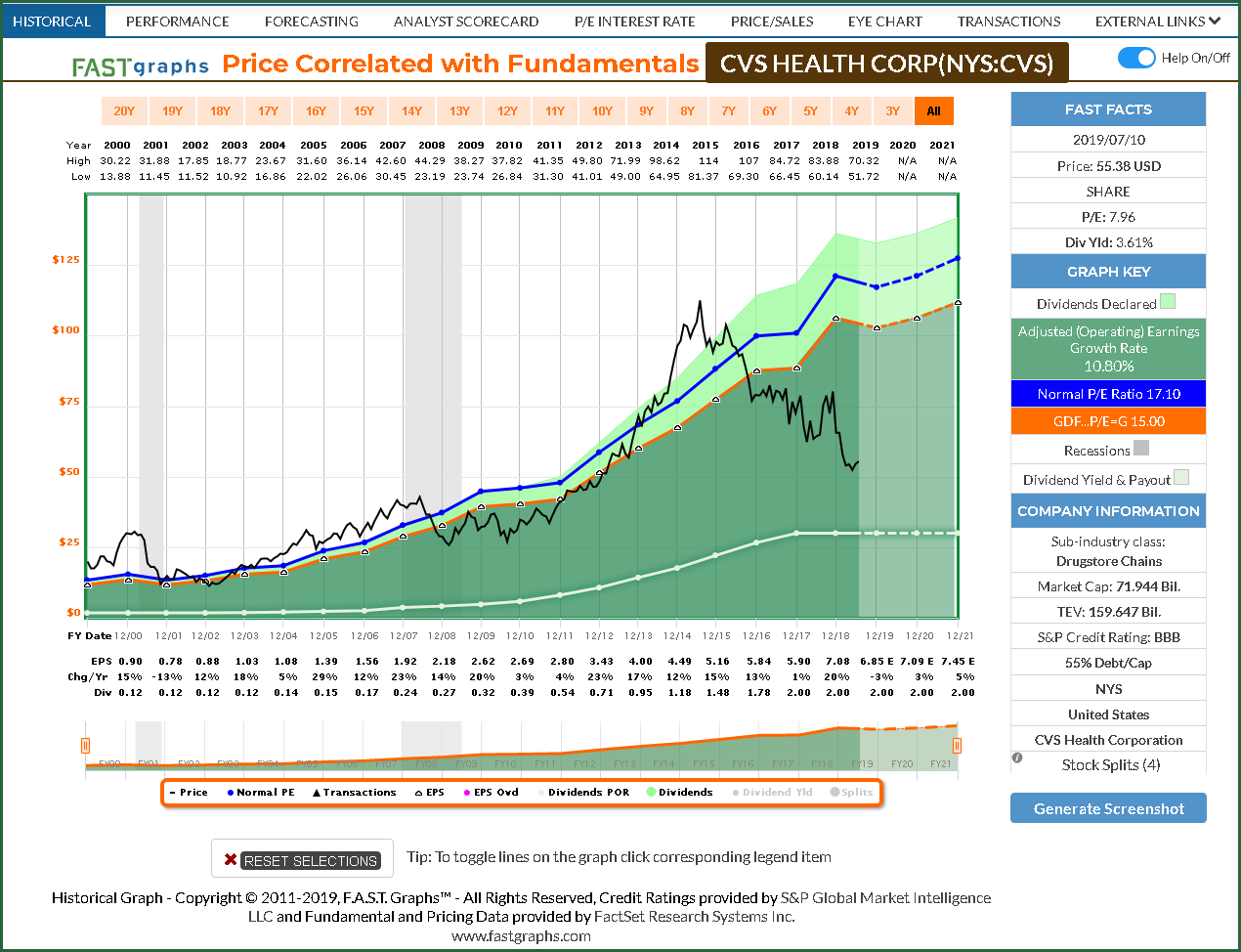

Since a picture is worth a thousand words, I offer the following screenshots to illustrate some of the points I have been discussing in this section on value. Remember, the orange lines on each of the following graphs represents a widely accepted calculation of fair value based on discounted cash flow analysis.

With my first example I present CVS Health Corp (CVS) which represents a deep value stock. CVS is clearly out of favor and trading at a valuation that is historically low relative to its fundamentals. Common sense would suggest that deep value stocks are clearly out of favor, and as such, will not be outperforming any other class in the short run. The performance opportunity with deep value stocks comes over the long run through P/E ratio expansion, growth and dividend increases. Importantly, it takes patience to invest in deep value stocks.

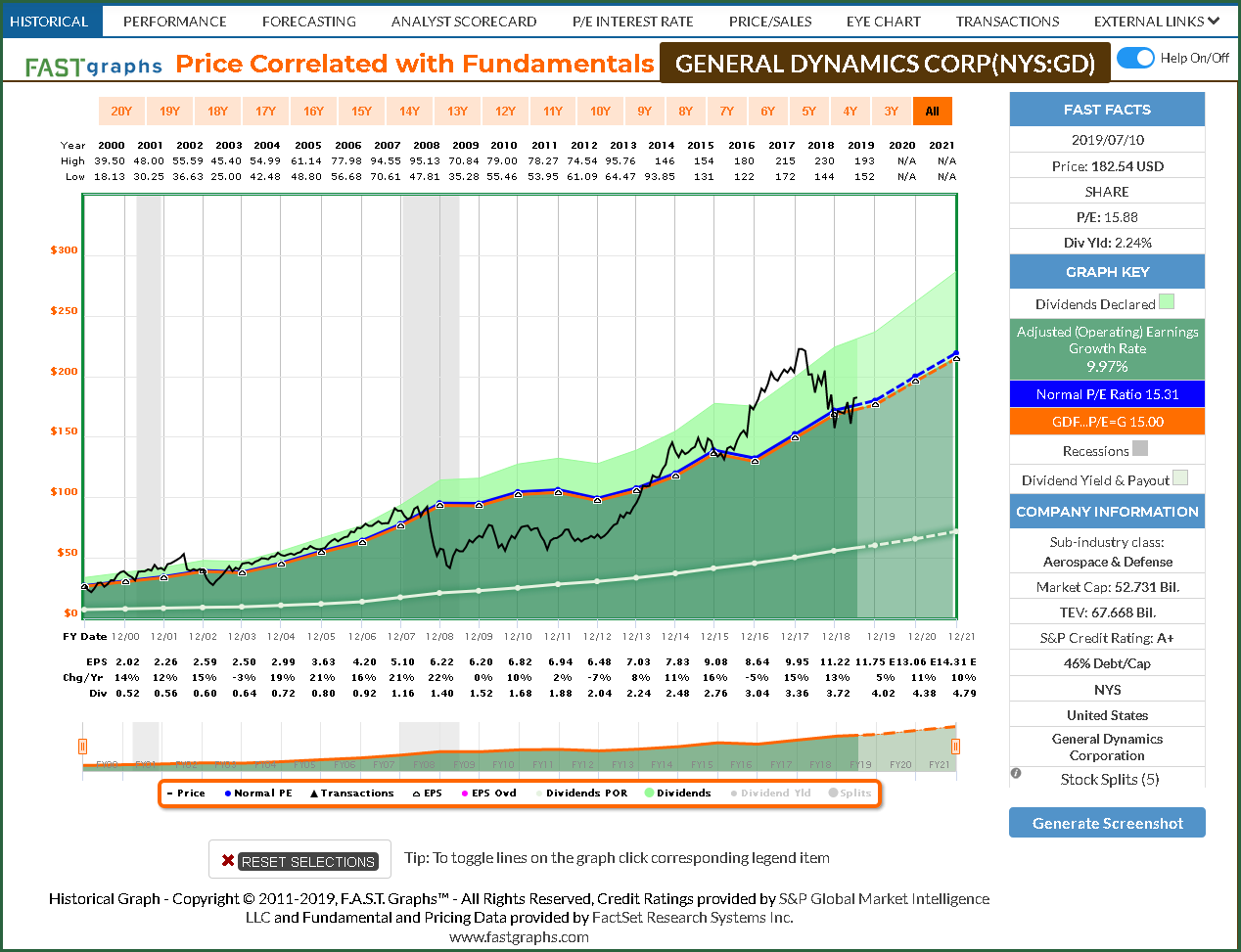

With my second example, I present General Dynamics (GD) a stock that is currently fairly valued. However, I also chose this example because it offers several other lessons on valuation. You can see that the company was fairly valued at the beginning of the graph and is now fairly valued at the end. Consequently, later in the video, I will show how the capital appreciation component over this timeframe is highly correlated to the company’s earnings growth rate.

I would also like you to note the numerous reversions to the mean of the stock price over this long-term timeframe. Especially noteworthy is the undervaluation that occurred after the great recession and over the timeframe when defense spending was being cut. However, the price eventually reverted to the mean, and then in 2017 overshot it to overvaluation. At this point, we see an example of how we could have avoided the obvious mistake of overvaluation had we been paying attention.

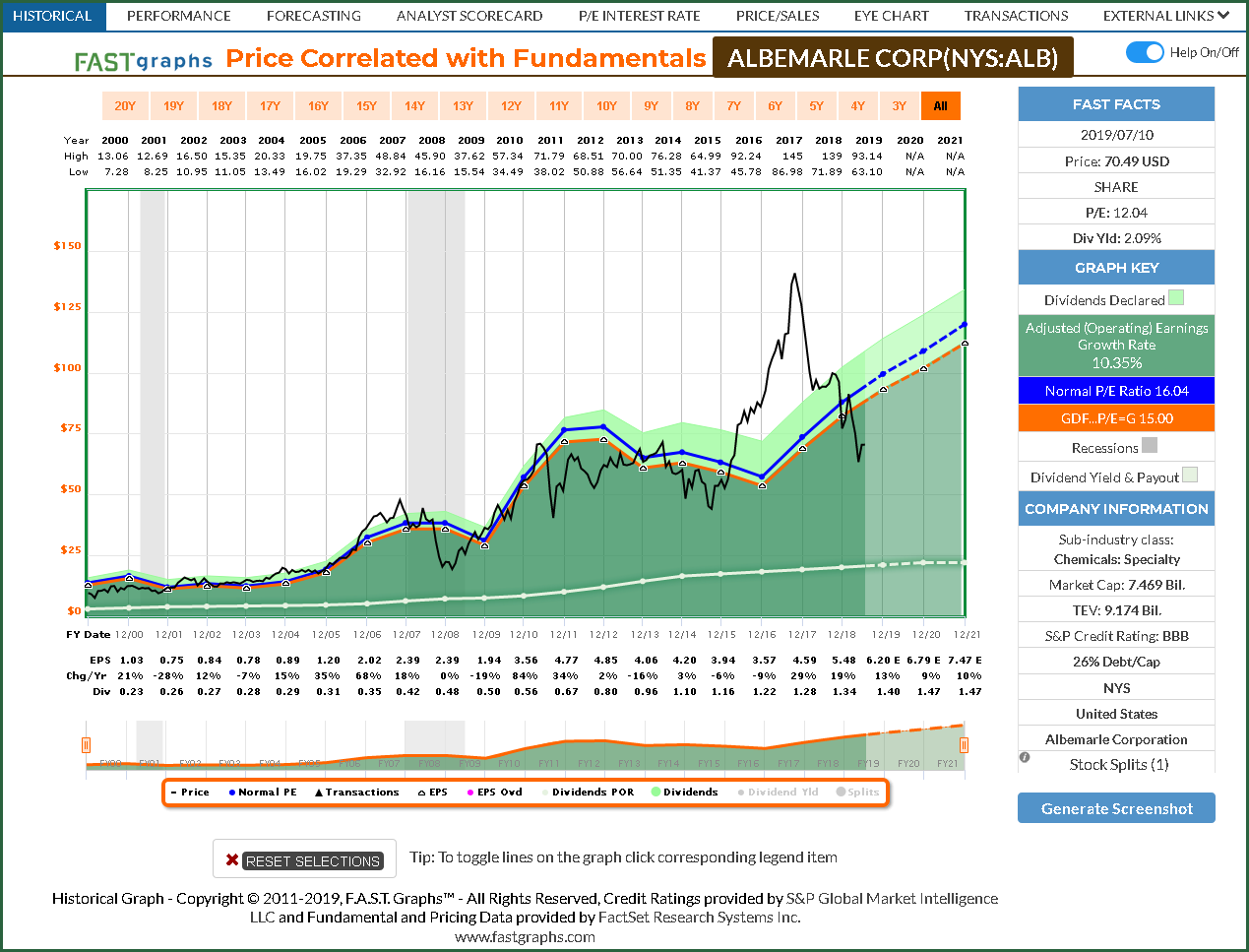

With my third example I present Albemarle as an example of a company that is significantly undervalued, but perhaps not quite at the deep value level. Moreover, this example also illustrates the importance of operating results driving stock prices over the long run. Finally, this example also illustrates an obvious overvaluation mistake spanning 2016 and 2017 that could have – and should have -been avoided.

Up to now, I have simply presented a discussion on how common stocks reward investors. More precisely I have discussed how rates of return are generated and what their sources are. These are concepts that are mostly common sense, and my experience tells me that people instinctively understand them once their minds are focused correctly. However, we operate in an industry that in my opinion at least would rather keep us in the dark than enlightened. Consequently, we are often distracted with what are, in my opinion, silly even nonsensical statements such as value beats growth or growth beats value.

Therefore, in the analyze out loud video I am going to expand on these concepts by providing examples that I believe support what I’ve written thus far. I will attempt to demonstrate that labeling a stock as a value stock or as a growth stock is an overgeneralization that is not useful. Most stocks grow at some level and they are either overvalued, undervalued or prudently valued. However, the valuation that the market is applying does not define what kind of a stock or classification they are. These are attributes that companies possess in an almost infinite variety. The key is to be specific rather than general. In other words, evaluate the company and its precise attributes without stereotyping it into a classification that is ill-defined and therefore may or may not apply.

Place video here

Summary and Conclusions

I want it to be perfectly clear that the purpose of this article was not to recommend any of the companies I used as examples. My purpose with this article was to discuss important principles associated with investing in common stocks. Instead of thinking about vague concepts such as value or growth, I believe it’s more beneficial to focus on the specifics that really do matter.

Disclosure: Long GD, CVS