Introduction

After today’s price drop, and frankly even before that, I thought that Whirlpool Corporation (WHR) represented a unique opportunity to invest in the world’s oldest and largest appliance manufacturer at extremely undervalued levels. I understand that there have been issues, but I see nothing that would suggest that the price should be this low. Whirlpool is a worldwide distributor of large and small appliances. These would include laundry appliances, refrigerators, freezers, cooking appliances dishwashers, mixers and other small domestic appliances. Recent weak EMEA (Europe, the Middle East and Africa) results, tariff concerns, increasing raw material costs, increasing freight costs and lowered earnings guidance have all contributed to investor concerns. Yet despite all of this, the consensus of leading analysts following the company expect double digit growth going forward. Consequently, I believe this is a time to be greedy while others are fearful.

From a financial perspective, the future rewards appear exceptional. The current dividend yield is approaching 4 ½%, and the dividend has increased at an average growth rate of more than 16% since 2012. The company has more than $1 billion in cash, and both operating cash flow and free cash flow are forecast to be very strong for this fiscal year and next. Consequently, I think their dividend is extremely well covered and positioned to grow going forward. Furthermore, I believe the company offers both above-average yield and significant intermediate term appreciation potential based on its extremely low valuation. Therefore, I believe Whirlpool offers a compelling mid to long-term opportunity for both income and growth-oriented investors.

About Whirlpool

Headquartered in Benton Harbor, Michigan, Whirlpool Corporation is an iconic brand that was founded in 1898. Whirlpool is a worldwide manufacturer of home appliances and related products. The company has operations across The Americas, Western and Eastern Europe, and Asia holding dominate market share positions in each region. Their major brands include: Whirlpool, Maytag, KitchenAid, Indesit, Consul, and Royalstar.

The company markets Whirlpool, Maytag, KitchenAid, Jenn-Air, Amana, Gladiator GarageWorks, Inglis, Estate, Brastemp, Bauknecht, Ignis, Indesit, and Consul. Whirlpool Corporation is the world’s largest home appliance maker. Their website also mentions Hotpoint, Diqua, Affresh, Acros, and Yummly brands.

Whirlpool primarily markets its products through major retailers and specialty retailers. However, the company also has a strong association with building industry professionals to include builders, designers, architects, distributors and others. Recently, the company announced the strengthening of this relationship with a state-of-the-art website “Whirlpool Pro”, designed to cater to the needs of professionals in the building space. According to Zacks Investment Research:

“Some of the key features of the website, aimed at unwinding improved understanding for builders and other professionals, include unique resources and tools; background and analysis of homeowners for better understanding of consumer trends; details of latest innovations from Whirlpool; and enhanced search capability and greater mobile compatibility.

This news did not boost to the company’s stock much, which closed after declining 2.7% on Oct 2. Overall, this Zacks Rank #3 (Hold) stock has witnessed a decline of 6.9% in the past month, wider than the industry’s fall of 4.5%. The company’s graph mainly suffers on account of increased raw material prices, lower sales volumes and adverse foreign currency translation.”

You can read more about their Building Industry Professionals website here:

October 2, 2018

Whirlpool Corporation Launches New Online Resource for Building Industry Professionals

Zacks went on further to explain that:

“these factors dented whirlpools top and bottom line performances for quite a while. Clearly, the company reported negative earnings surprises in seven out of the last eight quarters while second-quarter 2018 marked its fifth straight quarter of top-line miss. Moreover, the company trimmed its GAAP and adjusted earnings view for 2018 due to raw material cost inflation and other factors.

However, the company’s stringent focus on long-term goals for 2020 and innovation strategy, as well as global cost-based pricing and fixed cost-reduction strategies, is a silver lining. These strategies should aid Whirlpool in the long run.”

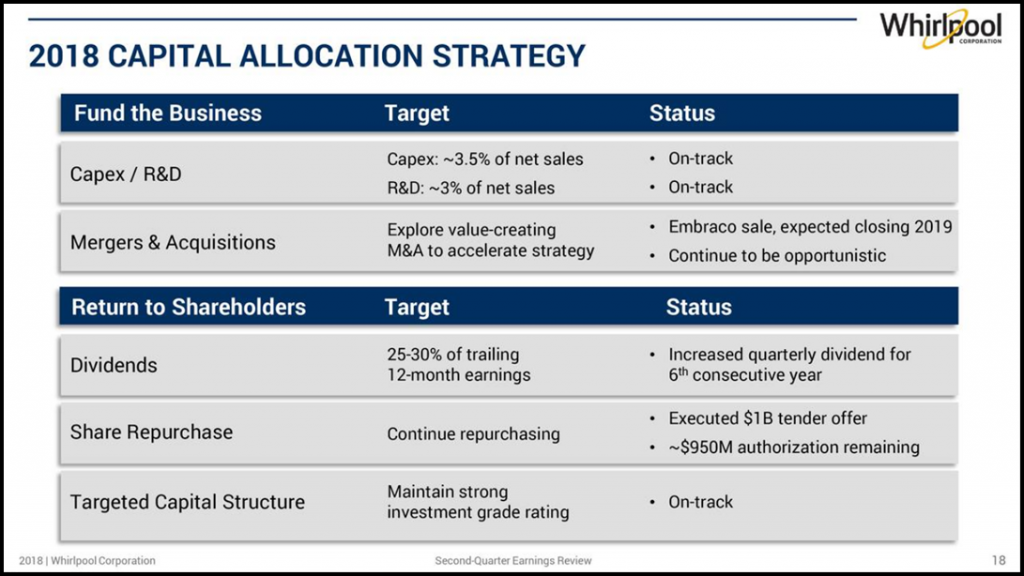

In their most recent earnings report, management provided their 2018 capital allocation strategy as follows:

Furthermore, I consider Whirlpool a very innovative appliance manufacturer. I even have a personal experience of my own. The laundry room in my home is located so that it requires a very long run for the vent for our dryer. This has been a concern because it has impacted the efficiency of our dryer and in my opinion has presented a fire hazard. Nevertheless, our clothes dryer finally failed, and we purchased an innovative new Whirlpool ventless clothes dryer. It works great, and there is no longer a fear of a fire erupting in our dryer vent. To illustrate how innovative our new dryer is, our salesman initially told my wife and I that there was no such thing as a ventless clothes dryer. However, his sales manager quickly corrected him, and we ordered and purchased our new appliance.

Here are some additional corporate press releases illustrating Whirlpool’s innovations:

May 8, 2018

Whirlpool Corporation enhances voice capabilities with Google Home in connected appliances

February 20, 2018

January 8, 2018

Whirlpool Corporation becomes first appliance maker to activate Apple Watch functionality

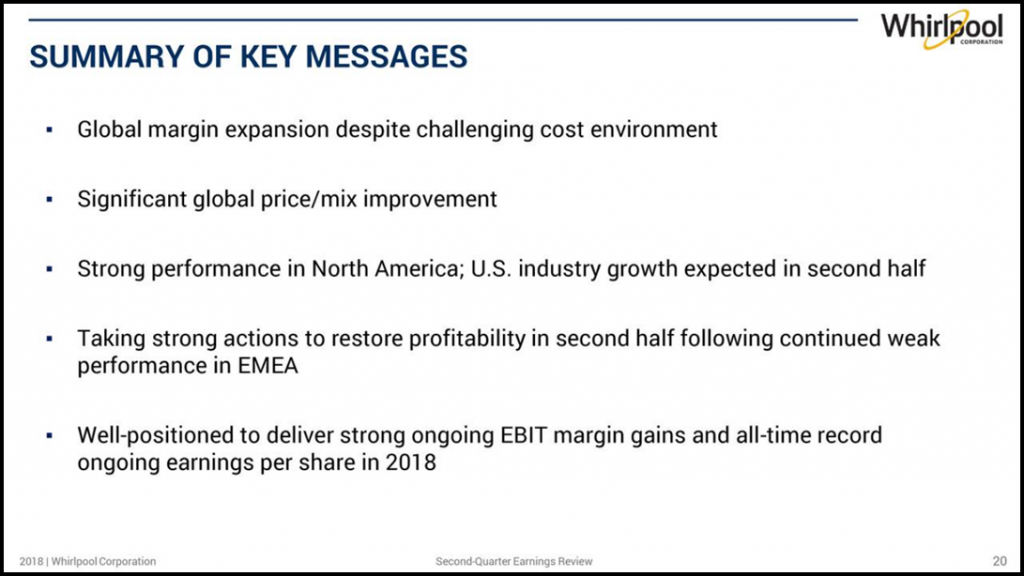

Furthermore, although the company has been experiencing some operating challenges in recent times, management is taking action to correct things for the future. Here is a summary of key messages from their most recent earnings report:

Investment Opportunities Come in Different Shapes and Sizes

Whether I’m investing for growth or income, my preferred strategies are to purchase great companies at attractive valuations for long-term ownership. This strategy of investing in wonderful businesses at sound valuations provides great results and simultaneously controls risk. Consequently, I consider it the optimum way to invest in equities. Unfortunately, markets do not always cooperate and provide opportunities to invest in truly great businesses at great valuations. In my opinion, we currently find ourselves in just such a market.

As a result, most of my favorite companies’ names like Church & Dwight Co., Inc., Nike, McDonald’s Corporation, Costco Wholesale Corporation, Visa, MasterCard, Ross Stores Inc., The Home Depot Inc., and the list goes on, are all too expensive to purchase at today’s levels based on fundamental values. Consequently, my best and preferred strategy for investing is not viable in today’s marketplace. Therefore, I am forced to turn to other strategies that my experience tells me also produces strong long-term results as well.

One of those strategies is to identify good businesses that can be purchased at significant discounts to their intrinsic values. With my preferred investing strategy, long-term rates of return are normally generated because of growth of earnings and dividends purchased at attractive values. With this strategy, long-term rates of return are generated by what I call natural leverage. You purchase a level of earnings at a very attractive valuation (extremely low P/E ratio) and then your future rewards will come because of the company’s valuation (P/E ratio expansion) reverting to its mean or normal levels.

In certain circumstances, this strategy represents a quintessential idea of buying low to sell high. As an aside, a high level of current dividend yield with prospects for future growth provide an enticing bonus. In my opinion, Whirlpool currently represents a great example of this opportunity as I will clearly illustrate in the analyze out loud video below.

FAST Graphs Analyze Out Loud Video: Whirlpool – An Uncommon Value Opportunity

Whirlpool is currently trading at a significant discount to their fundamental value and strength. As I will illustrate, the company has a solid balance sheet with over $1 billion of cash on hand, and an above-average dividend and dividend yield that is well covered by operating cash flow and free cash flow. Consequently, I consider this a great opportunity to buy an established business at a fire sale valuation. If I am right, both income and capital appreciation would be exceptional over the next 3 to 5-year timeframe.

Summary and Conclusions

Historically, Whirlpool has not been the fastest growing company that I have ever looked at or invested in, nevertheless, growth since the Great Recession has been very strong. On the other hand, earnings for 2017 and expectations for 2018 have fallen back to longer term historical normal low levels. In my opinion, this has created an exceptional opportunity to invest in this iconic appliance maker at a very attractive valuation. As a result, I see very little downside longer term, but exceptional upside at least over the next couple of years. Therefore, I offer this research candidate for investors that are seeking high current income and for investors who are looking for above-average capital appreciation over the intermediate term.

Disclosure: Long WHR

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.