Introduction

The top 3 Medical DistributorsAmerisourceBergen (ABC), Cardinal Health (CAH) and McKesson Corp. (MCK) dominate the distribution of pharmaceuticals and are estimated to represent 90% to 95% of the market. Moreover, each are dividend growth stocks, and as a specific subsector group all appear significantly undervalued. Therefore, it is reasonable to assume that the issues are more subsector related than company specific. As a result, the seminal questions to ask – are these companies a bargain or is there a systemic issue that threatens to make these companies and their industry irrelevant?

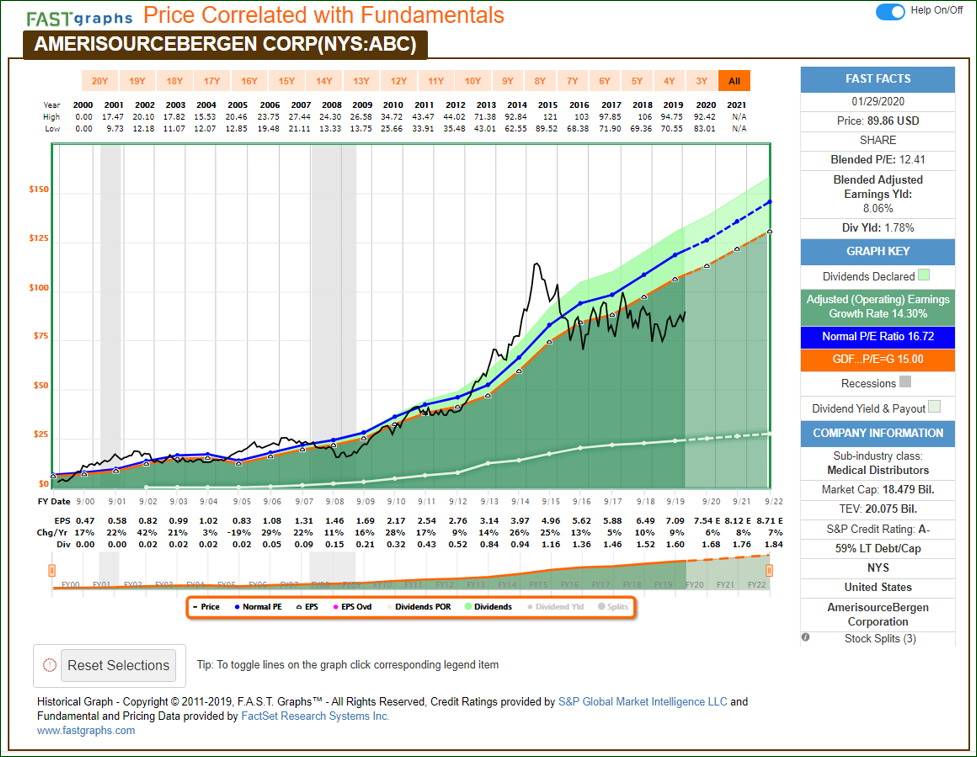

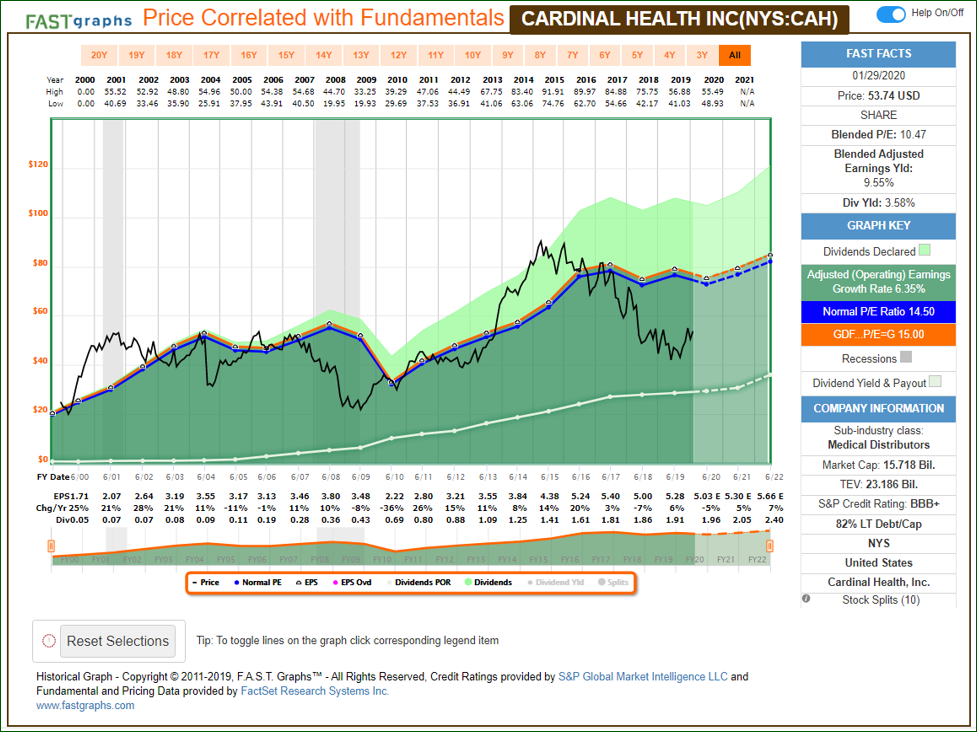

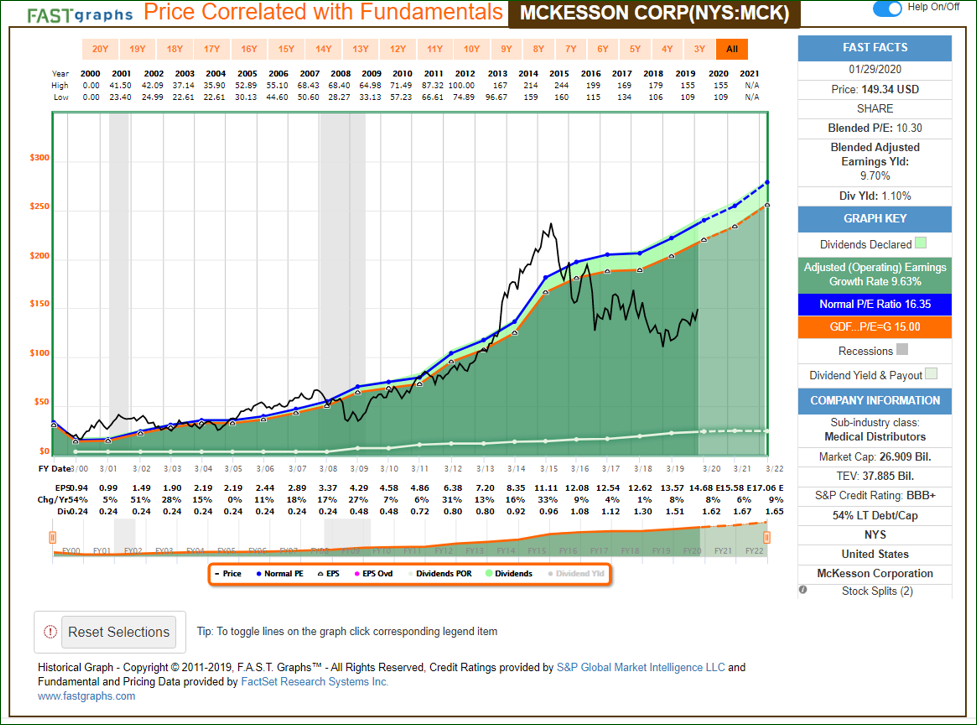

From a fundamental’s point of view, McKesson and AmerisourceBergen appear especially strong. Even though Cardinal Health’s fundamentals are not quite as stellar, they appear strong enough to support a higher valuation than Mr. Market is currently awarding them. Furthermore, although each of these companies operate in the same industry sector, they are similar but not the same. MorningStar offers the following insights into the minor differences between each of these dominant medical Distributors:

“McKesson, AmerisourceBergen, and Cardinal Health effectively operate as an oligopoly and are entrenched in their customer base. The three leading distributors are similar but differ slightly. McKesson is the largest pharmaceutical distributor with certain global contract manufacturing capabilities and is more vertically integrated with providers and retail pharmacy chains in Canada and Europe.

AmerisourceBergen is the closest to a pure-play pharmaceutical distributor with a platform based inside of or very close to providers and retail pharmacies.

Cardinal Health is the smallest of the three, with certain private-label commodity manufacturing capabilities and medical devices.

The companies’ investments in IT infrastructure provide the ability to navigate the highly regulated drug market. Scale also enables the companies to negotiate on behalf of providers and retail pharmacies. The required infrastructure, regulatory hurdles, and required logistics management insulate the companies from new entrants.”

With Investing In Common Stocks Knowledge Is Power

The better informed you are as an investor, the better the investment decisions you can make. But being an informed investor can be a very arduous task, and some would even say that conducting research on common stocks is a real snoozer. Poring over mounds of financial data and trying to piece this information into meaningful and useful knowledge is not the average person’s idea of a good time. Most people have better things to do with their time yet recognize that making sound financial decisions is critical to their future financial health and security.

Furthermore, before investing in common stocks, it’s logical to assume that the more you know about the companies you are investing in, the smarter you can be about making good choices. As previously stated, researching common stocks can be tedious, confusing and complex. But investing in common stocks without thoroughly understanding what you’re buying or what you own can be foolish and dangerous to your financial health at the same time. Therefore, I believe that most rational investors would agree that a comprehensive and thorough research process before investing is prudent and necessary.

Consequently, if you’re not willing to do the job yourself, then hiring a professional that you believe is competent, engages in an investment philosophy that is aligned with yours and that you can trust might be a reasonable course of action. Even then, most investors would be more comfortable with their portfolios if they understood what they own and why they own it. Knowledge is power, and regarding investing, I believe clearly understanding your investments is an essential key to achieving financial success and controlling the amount of risk taken to achieve it.

However, at the same time you should not be naïve about what you can know. Common sense suggests that you cannot know what the insiders of the company know about its business and its future. Instead, you can simply possess a basic understanding and then attempt to make rational assumptions based on your layman’s view.

Important Considerations Before Investing: Learning From The Past

Before investing in a common stock, it just seems logical to me to possess key information that reveals the quality and the value of the business being considered. Therefore, it seems only reasonable to ask and answer some key questions about a business before laying your money down. For example, what kind of an operating track record has the company produced? How reliable have their earnings and cash flows been over the years? How fast have they grown and how consistent has the growth been? This seems like logical knowledge to gather before investing.

Additionally, for those investors looking for dividend income and growth, there are several questions that the discerning investor might ask about the company’s dividend record: Are the dividends growing, and if so, at what rate and how consistently and for how long? Have they ever cut their dividend, and if they did, why? What about the payout ratio; is it reasonable and is it increasing or decreasing? Most importantly, are cash flows covering the dividend? Also the investor might ask; what has been the cumulative total amount of dividends paid over a given period, and what has been the nominal yield and yield on cost (growth yield) that the stock has delivered?

Additionally, there are other questions regarding a company’s fundamental values that a discerning investor should ask and have answers to. How has the market historically capitalized a given company’s fundamental results? How do these valuations compare with other companies in other industries? And of course, and perhaps most importantly, how’s the market valuing the business today; is it overpriced, underpriced or fairly priced? Although this information requires a level of interpretation on the part of the researcher, clear answers can greatly facilitate the decision-making process and lead to a successful outcome.

Important Considerations Before Investing: Forecasting The Future Is Key

Questions like those above, and many more, are easy to ask but time-consuming to answer. Although the information is readily available on public companies, it must be pieced together from financial statements or other data sources. Once the information is gathered, then numerous calculations must be made in order to answer the proposed questions.

Nevertheless, even if gathering this historical information is time-consuming, the above questions are not the most important ones. Certainly, assessing a company’s operating track record is important, but what is more important is to make a reasonable estimate of what the company’s future might bring. As stated earlier, we can learn a great deal from the past. However, we must also recognize that we can only invest in the future.

Therefore, as investors our most important job is to prepare a reasonable forecast of each company’s future success. If we can do that within a reasonable range of accuracy, we can then calculate reasonable potential rates of return that the companies might be capable of offering us. As an aside, I never invest in a common stock without having a reasonable expectation of the rate of return I can expect it to provide me.

Therefore, we simply cannot escape the obligation to forecast – our results depend upon it. However, our forecasts should not be mere prophecy and we should not simply guess. Our money is too important to simply play hunches. As a result, we need to calculate reasonable probabilities based on all available “factual” information that we can assemble. From there, we should apply analytical methods that provide us reasons to believe that our choices can produce earnings growth that will reward us in the future.

However, we must also be realistic and recognize that ascertaining a perfect forecast is virtually impossible except by chance. On the other hand, it is also practical to establish a range of possibilities where we might have an expected case as well as best case and worst-case scenarios. But it is critically important, that once these forecasts are made, we must continuously monitor the company’s progress as time passes.

The good news is most of the information we need will only be made available quarterly when the companies produce their financial statements. There might be the occasional major announcements that are made between quarterly reports, but these tend to be rare. My point is that continuous monitoring does not imply obsessing over every tick in the stock price or scintillating headlines that, more often than not, simply represent noise rather than news. Therefore, continuous monitoring would only imply conducting heavy lifting research on each company quarterly. The key is to keep our emotions in check.

AmerisourceBergen, Cardinal Health and McKesson Corp.: Essential Fundamentals At A Glance

From the above screenshots, each of these dominant Medical Distributors are clearly trading at significant discounts to their fundamental values and their historical norms. Moreover, this also suggests that, as I previously stated, it is sector rather than company specific. The negative sentiment surrounding these companies despite good fundamentals are related to the “opioid epidemic and not too weak business results.” Consequently, we might initially want to look at what the potential liability that each company might face.

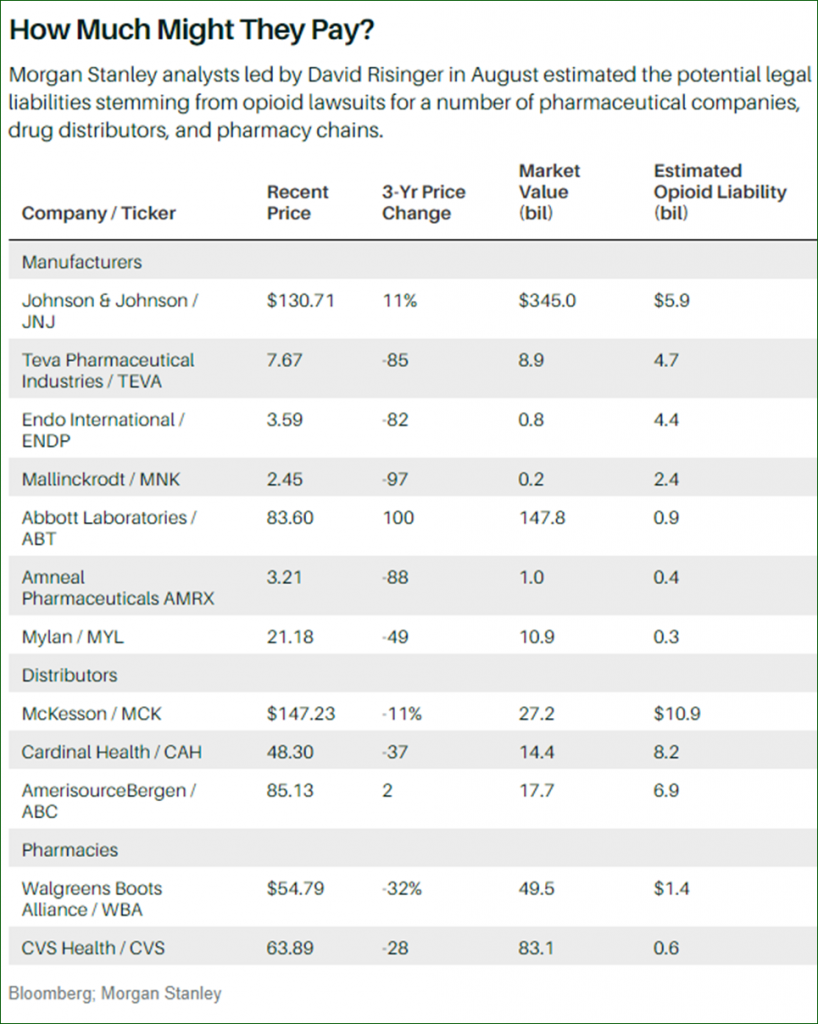

There are those such as Charles Rhyee, a Cowen analyst who has an outperform rating on all 3 because he believes that the reaction has been overdone. Other industry experts recognize that these companies face challenges, however, they also believe they all remain essential to the drug makers and pharmacies that they serve. A Barron’s article reported that Morgan Stanley analysts offer the following assessment of what various pharmaceuticals and drug distributors liabilities might be:

FAST Graphs Analyze Out Loud Video: AmerisourceBergen, Cardinal Health and McKesson Corp.

With the following video I will provide answers to the many questions I posed earlier. I will examine each company’s track record, their dividend histories their typical valuation levels, etc. Furthermore, I will examine each of these companies with the primary focus on earnings, cash flows and dividends.

Summary and Conclusions

I believe that each of these companies are high-quality dominant companies in their respective subsector. Moreover, I believe that each of these companies are extremely attractively valued relative to their fundamental values and historical norms. Consequently, I believe they offer prudent long-term dividend growth investors significant return opportunities over the long term.

Additionally, these 3 companies provide a choice for most every dividend growth investor. If you’re looking for high current income, then Cardinal Health would fit the bill. If you’re looking for high total return with significant dividend growth, then either AmerisourceBergen or McKesson Corp. could be your best choice.

Finally, the real question that needs to be answered is whether (or not) the opioid crisis is potentially devastating. Based on the estimates of the liabilities provided by Morgan Stanley analysts, I would argue that each of these companies would easily survive and eventually prosper. However, as always, I leave that aspect of your research and due diligence to each of you. Caveat emptor.

www.fastgraphs.com

Disclosure: Long ABC,CAH

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.