REIT Omega Healthcare Investors Inc (OHI)

Short-term pain leading to long-term gain.

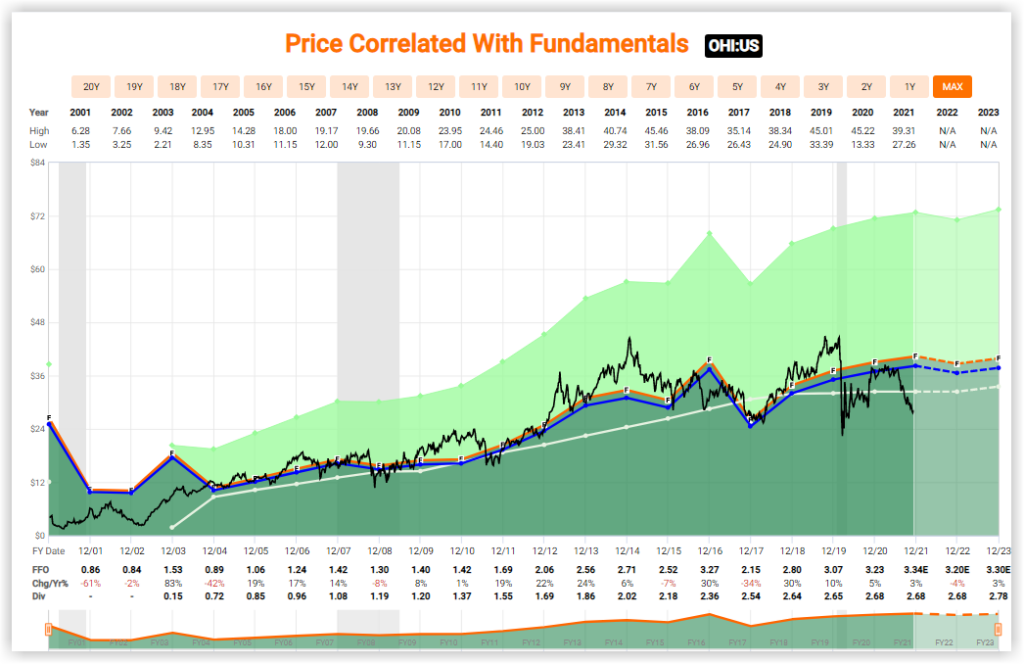

Subscriber Request Series this week is Omega Healthcare: Update after recent price drop. In this video Mr. Valuation will illustrate that that despite temporary issues, Omega Healthcare represents a long-term opportunity for significant income and capital appreciation. In short, the company’s operating results support a higher valuation and this well-managed real estate investment trust (REIT) offers investors long-term potential at low levels of risk. The presentation I refer to in the video can be found here.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long OHI at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.