Lockheed Martin Stock Analysis

Lockheed Martin produced a mixed Q3 2021 financial report. Non-GAAP Earnings beat estimates by $0.13 and GAAP earnings beat estimates by $0.22. However, the company’s revenues were short and management guided future revenue growth lower. The market’s reaction was severe with one pundit producing the headline: “Lockheed Martin plunges on bearish revenue guidance; to reassess five-year plan.” With this video I will illustrate why I believe the market overreacted bringing this Dividend Contender with its 19-year streak of increasing its dividend into fair value range.

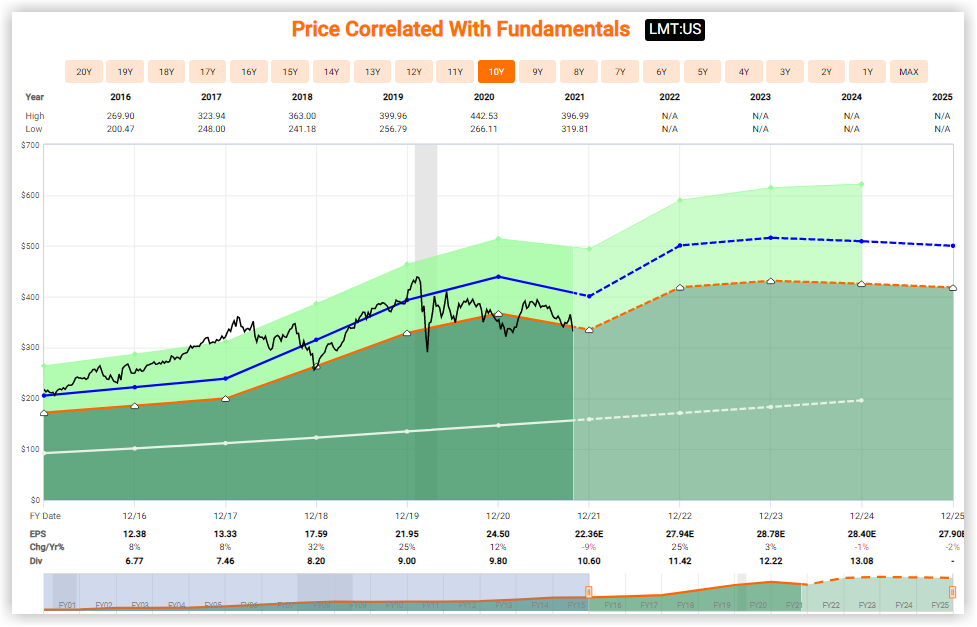

FAST Graphs Analyze Out Loud on Lockheed Martin (LMT)

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long LMT at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.