5 A Rated Life and Health Insurance Dividend Growth Stocks

Since the recession of 2008 in 2009, financial stocks in general have been trading at significantly lower valuations than normal. This creates several opportunities for the value investor. First of all, there is always the potential turbocharging of your performance if the stocks move back into a more normal and comparable valuation ranges. However, many of the high-quality dividend growth stocks in the financial sector are cheap today by any standard definition of valuation.

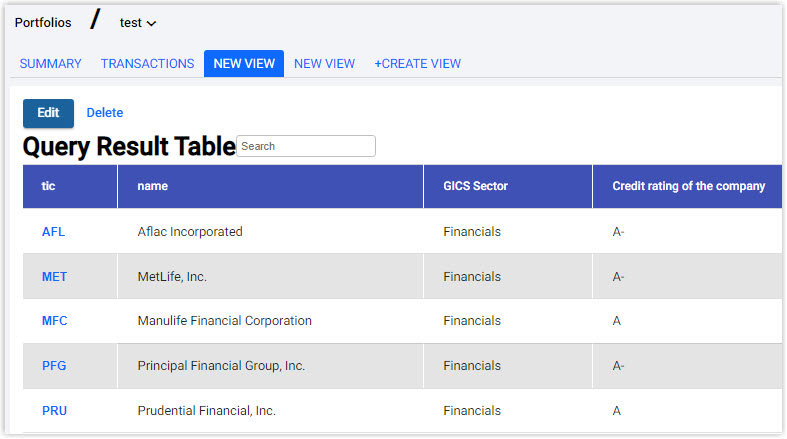

In this video we cover 5 very high-quality A rated or better life and health insurers all with long-term debt to capital levels of 25% or lower. Moreover, each of the 5 stocks I cover today offer dividend yields much higher than the yield you can get from the SPY. This combination of quality, low valuation, and high-yield make these blue-chip dividend growth stocks worthy of further evaluation by the prudent dividend investor.

The Stocks I will go over are Aflac (AFL), MetLife (MET), Manulife Financial (MFC), Principal Financial Group (PFG), Prudential Financial (PRU)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long AFL, MFC, PFG, PRU at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.