Dividend Growth Stocks

Throughout the duration of the recent bull market (one of the longest on record) common stocks in the general sense became significantly overvalued. Moreover, with interest rates simultaneously hovering at all-time lows, best-of-breed dividend growth stocks were among the most mis-appraised of all.

Finally, for many reasons, but to a great extent rising interest rates, the worm has turned. The bull market has turned into a bear market. As a result, stocks of all categories, types, and flavors have corrected significantly. But there is a caveat. Despite the current bear market, and despite the fact that most stocks have fallen recently, once again in the general sense, valuations remain higher than prudence would dictate.

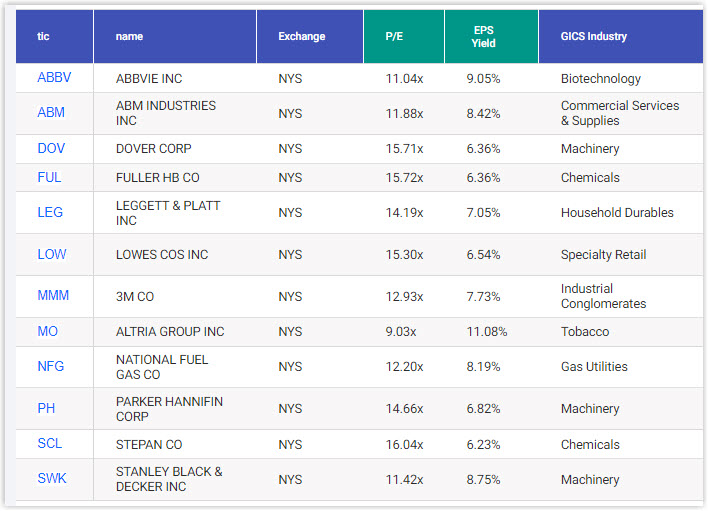

But as I often state, it is a market of stocks and not a stock market. Therefore, there are certain stocks that have become prudent, safe, and opportunistic long-term investments. In this video I offer 12 Dividend Kings which are the best of the best dividend growth stocks currently on sale. Regardless of all the angst that bear markets bring, investors need to be cognizant of the fact that with the pain comes opportunity

In this video I will go over Stanley Black & Decker (SWK), ABM Industries (ABM), Dover Corp (DOV), HB Fuller (FUL), Leggett & Platt (LEG), Lowes (LOW), 3M Co (MMM), Altria Group (MO), National Fuel Gas (NFG), Parker Hannifin Corp (PH), Stepan Co (SCL), AbbVie (ABBV)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long SWK, LEG, MMM, MO, ABBV at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.