Introduction Dow Jones Industrial Average

Only 10 of 30 stocks are attractively valued blue-chip stocks making up the Dow Jones Industrial Average (DJIA) today. The other 20 range from being moderately overvalued to dangerously overvalued. Although historically the Dow Jones Industrial Average (DJIA) was often referred to as the market, in recent years that has changed. The Dow was first created in 1896 by the Wall Street Journal and Dow Jones & Company. Initially it only had 12 stocks.

Today, there are 30 stocks in the Dow Jones representing 9 of the 11 sectors. The only sectors missing are utilities and real estate. Even today it is one of the most widely followed equity indices, however, many do not consider it the best representation of the market because it only has 30 large companies and is not weighted by market capitalization. Nevertheless, I consider it a concise index that can provide indications of the overall value of the stock market. Today, I would rate the Dow Jones Industrial Average as significantly overvalued.

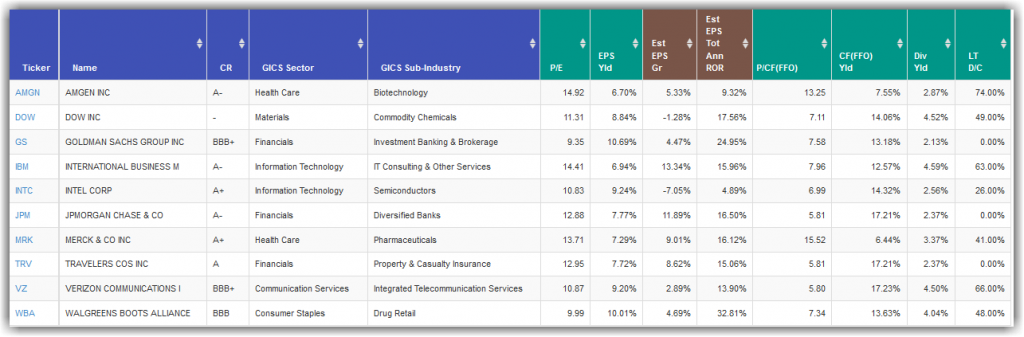

On the other hand, of the 30 Dow Jones stocks there are 10 that I consider attractively valued. In contrast, the other 20 appear to be significantly overvalued. Furthermore, it is also enlightening to evaluate the 30 stocks in the Dow because they are all premier large blue chips with strong brand identity.

In this video I will go over these companies: Goldman Sachs (GS), Walgreen (WBA), Intel Corp (INTC), Verizon (VZ), Dow Inc. (DOW), JP Morgan Chase (JPM), Travelers (TRV), Merck & Co (MRK), International Business Machine (IBM), Amgen (AMGN)

FAST Graphs Analyze Out Loud Video

Disclosure: Long WBA, INTC, VZ, TRV, MRK, IBM, AMGN at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Try FAST Graphs for FREE Today!