Introduction Portfolio Construction

In building a dividend income portfolio, or any portfolio for that matter, you need to approach portfolio construction with common sense and realistic appraisal of your own emotional abilities and tendencies. In other words, know thyself. Establish a plan that suits your goals needs and objectives and then follow that plan. To be clear, each portfolio selection should be chosen to do a specific job that includes realistic goals, objectives, needs, and risk tolerances. Be sure to diversify properly. However, not too little, or too much. Knowledge is power, therefore build a portfolio that you can have confidence in. Finally, there is no substitute for continuous monitoring, research, and due diligence. In short – manage your portfolio.

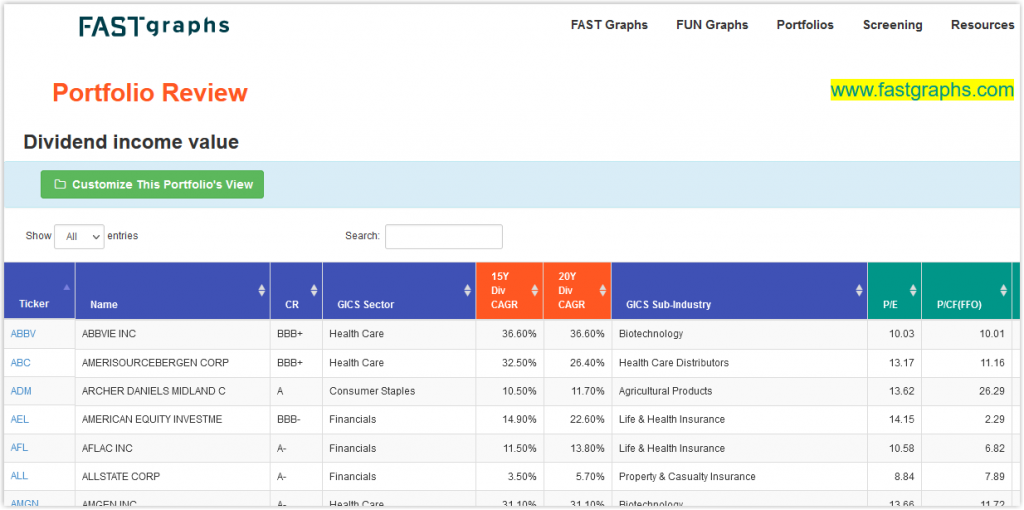

FAST Graphs Analyze Out Loud Video – Constructing a Dividend Income Portfolio

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.