Introduction – Canadian Banks

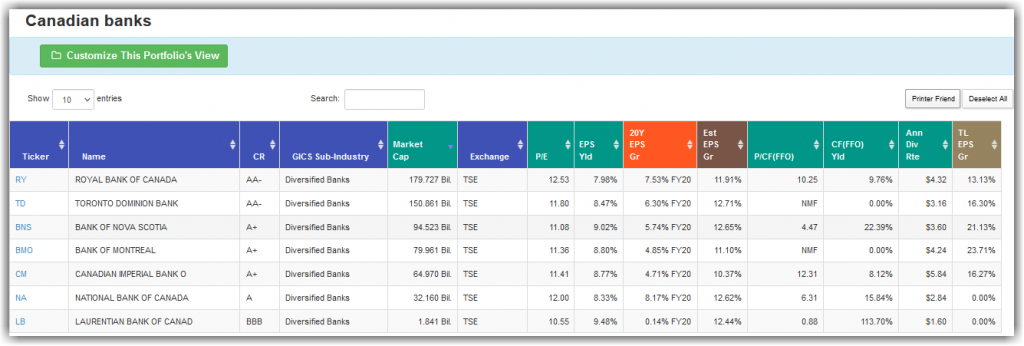

This week’s subscriber request video will look at the 6 leading Canadian banks. The top 6 banks in Canada hold roughly 90% of Canada’s banking deposits. Although there is a lot of similarity in their respective historical operating results, there are important differences amongst the 6 leaders. With this video I will illustrate how each of the 6 largest Canadian banks are attractive dividend growth stocks in today’s mostly overheated market.

Additionally, since 5 of the top 6 are dual listed on both the New York Stock Exchange and the Toronto Stock Exchange, I will provide an interesting perspective on the difference between evaluating these banks in either US or Canadian dollars.

In this video I will review: Royal Bank of Canada (RY), Toronto Dominion Bank (TD), Canadian Imperial Bank (CM), Bank of Montreal (BMO), National Bank of Canada (NA), Bank of Nova Scotia (BNS), Laurentian Bank of Canada (LB)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long RY at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.