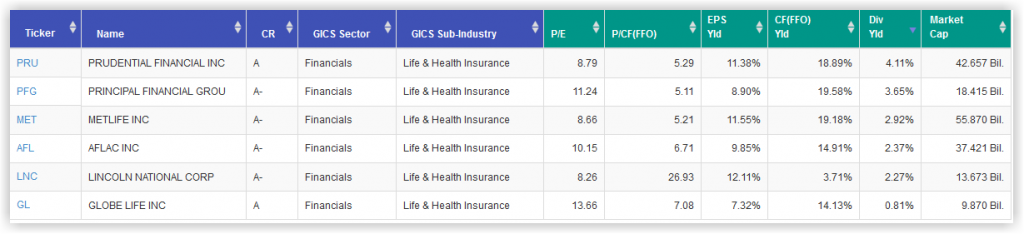

6 Dividend Growth Healh & Life Insurance Stocks

Prudential Financial is the highest yielding dividend growth stock and most undervalued life and health insurance company in the S&P 500. Therefore, I consider it the best buy among the 6 life and health insurers that are constituents of the S&P 500. Nevertheless, in this video I am covering the 6 premier life and health insurers included in the S&P 500. As I often say, it is a market of stocks and not a stock market. With that said, one sector of the overall market as measured by the S&P 500 that is attractively valued is the financial sector.

Ever since the financial debacle of the great recession which ended in 2009, financial stocks of all categories have been trading at historically low valuations. This includes the 6 life and health insurers, dividend growth stocks, covered in this video. As a result, life and health insurers can be confidently invested in based on valuation and their unique operating histories. Moreover, there is a potential kicker that could be enjoyed if these high-quality financial sector companies once again become more appropriately valued by Mr. Market.

The companies I will review in this video that pay a dividend are: Prudential Financial (PRU), Principal Financial (PFG), MetLife Inc (MET), Aflac (AFL), Lincoln National (LNC), Globe Life (GL)

FAST Graphs Analyze Out Loud VIdeo

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long PRU, PFG, AFL at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.