Introduction

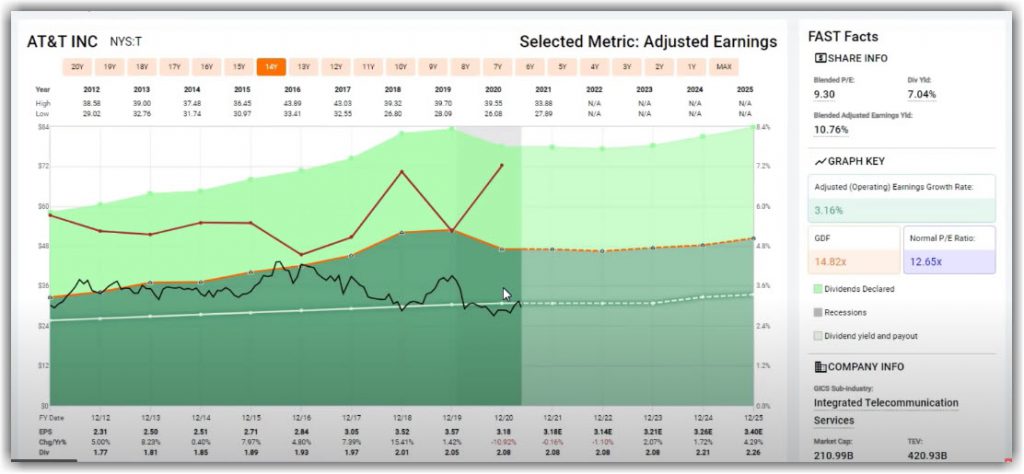

Is AT&T a value trap or dividend income turbo charger?

Valuation is relative to the growth rate of the companies in question. And I think this is something that people often overlook. Just because you buy a stock at a good value, it does not simultaneously mean you are going to make a lot of money. Valuation is more about risk control and prudence than it is total return. Therefore, it really depends on the characteristics of the stock you are buying and what it offers as an investment. Some stocks offer growth, some stocks offer high income, moderate income, or none.

Therefore, it makes sense to choose stocks that meet the investment objective that you seek. In the case of AT&T (T), it was all about high current yield. This is analogous to people investing in CDs, annuities, bonds, or other fixed income. They do not make those investments believing they are going to get rich. Instead, they typically make those investments with the objective of safety, predictability, and a consistent income stream.

Nevertheless, AT&T is about to become a very different company. With this video I will attempt to shed light on what that means for AT&T shareholders going forward. AT&T was an investment made to turbocharge the yield of the dividend income portfolio I was building. In essence, there is a place for everything and everything in its place. AT&T had a logical place and it performed as expected. But what about the future?

FAST Graphs Analyze Out Loud Video Reviewing AT&T

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long T at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.