Dividend Growth

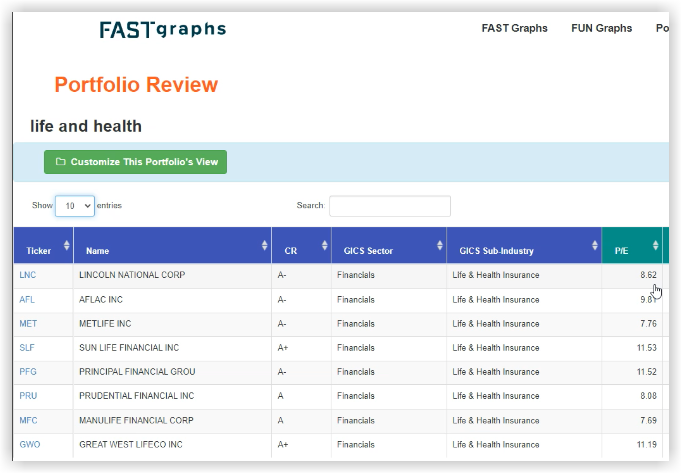

In this video I present 8 undervalued dividend growth stocks with dividend yields ranging from 2.51% to 5.11%. All these companies are undervalued in what is a very overheated stock market today. Nevertheless, as I always say it is a market of stocks and not a stock market. Therefore, despite the high value of the overall stock market as measured by the S&P 500, each of the stocks are attractively valued. Better yet, they are all high-quality A rated or better life and health insurers with moderate levels of debt. I offer these as extremely high-quality dividend growth stocks as prospective research candidates. In other words, I believe there are attractively valued dividend growth stocks among this list to satisfy virtually every investor’s needs whether that be current income or total return.

These are the companies I will be covering in this video: Lincoln National (LNC), Aflac (AFL), Sun Life Financial (SLF), Principal Financial Group (PFG), Prudential Financial (PRU), Manulife Financial (MFC), MetLife (MET), Great West Life (GWO)

FAST Graphs Analyze Out Loud Video on 8 Life and Health Stocks with Dividends

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long AFL, PFG, PRU, MFC

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.