Introduction – 7 Stocks to Buy Today

With interest rates at all-time lows, investors needing income have flocked to utility stocks driving most of them to unattractively high valuations. Although this is true for most all high quality dividend paying stocks, the problem is exasperated when evaluating utility stocks. For starters, most utilities are regulated, which limits their growth. Consequently, utility stocks are often considered defensive income vehicles rather than capital appreciation opportunities. Therefore, when utility stocks get overvalued like they are today, their primary opportunity and allure is dramatically reduced.

For the most part, utility companies distribute electricity, water or gas to consumers and businesses in their geographic area. Many investors consider utility companies defensive because they provide essential services. Some pundits even allege that regulated utilities especially have less exposure to market volatility. Following this up by stating that they tend to be more stable during recessionary periods. With this video I will test that thesis in the real world utilizing FAST Graphs, the fundamentals analyzer software tool. The results may surprise you.

In truth, there are advantages to investing in utility companies. For starters, utility stocks operate straightforward businesses that are easy for investors to understand. Moreover, generally speaking, utility stocks pay higher dividends than most dividend paying stocks. But there are also risks that should be considered. Rising interest rates are a big one because utility stocks are negatively affected to an even greater extent than most dividend paying stocks. In summary, utility stocks are stable but typically low growth businesses that pay higher dividends than most. However, they are not generally considered great capital appreciation opportunities. Nevertheless, here are 7 utility stocks that can be utilized in dividend growth portfolios today. As always, I recommend conducting your own comprehensive research and due diligence prior to investing.

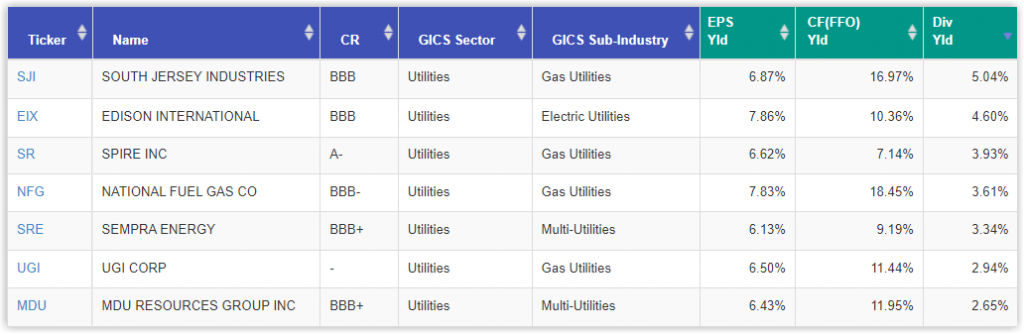

The companies I will be reviewing are: Edison International (EIX), MDU Resources Group (MDU), South Jersey Industries (SJI), Sempra Energy (SRE), UGI Corp (UGI), National Fuel Gas Co (NFG), Spire Inc (SR)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: No positions.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.