Dividend REITs for Income

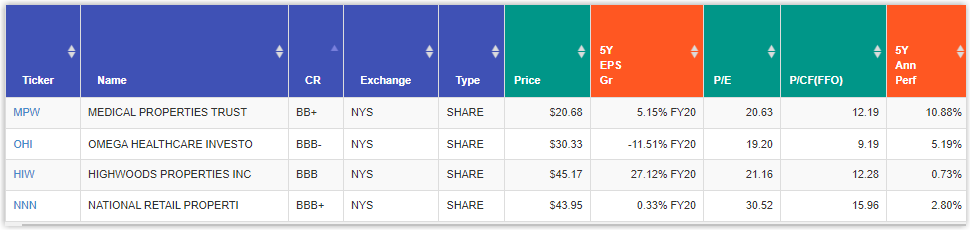

Here I will cover 4 REITs that have a dividend. Real Estate Investment Trusts are excellent vehicles for generating high income over time. However, just like most other income generating equity investments, it’s hard to find good value in this sector in this low interest rate environment. Fortunately, I identified 4 high quality dividend REITs each yielding over 4% and one offering more than 8% income for you to research and consider. Three of these REITs are investment grade and one is one notch below.

Additionally, there are factors regarding investing in REITs that need to be considered. With this video I will cover some of the more important considerations and unique factors regarding REIT investing. As you watch the video, keep in mind that the most salient feature of investing in REITs is a generous and growing income stream. Consequently, they are excellent instruments to augment a retirement portfolio or any portfolio where the investor is either living off the income or using it to supplement their current lifestyle.

In this FAST Graphs Analyze Out Loud Video I will review: Omega Healthcare Investors (OHI), National Retail Properties (NNN), Medical Properties Trust (MPW), Highwoods Properties (HIW)

FAST Graphs Analyze Out Loud Video

How To Analyze REITs with FAST Graphs

When evaluating REITs, FFO (funds from operations) is the most appropriate metric. This has to do with the law that governs qualifying as a REIT, and their requirements for distributing income. The metric AFFO (adjusted funds from operations) has been added. If you are in a regular corporation and want to evaluate a REIT, type in the REIT symbol and then choose the Cash Flow metric. When the REIT is drawn, it will automatically bring up FFO (Funds From Operations). However, just below FFO you will find an AFFO option. Once you are looking at REITs, these options will remain available. We suggest evaluating REITs utilizing both. However, if you move on to a regular corporation, the “Cash Flow” option will automatically be applied.

Most REITs have only been reporting AFFO for the last nine years or so. Consequently, we don’t have a lot of historical data. AFFO does not have a uniform definition that is universally applied by all REITs. The calculation of FFO is more standardized. With that said, the advantage of AFFO is that it is considered a more precise measure of residual cash flow available and therefore, a better predictor of the REITs’ capacity to pay dividends.

In a similar fashion, when evaluating MLPs, the most appropriate metric is cash flow.

F.A.S.T. Graphs™ will automatically report FFO when the cash flow option is chosen, and automatically report cash flow for all other types of companies.

When using these options, it’s important to emphasize the idea that the orange line is relevant as it is with other companies. However, since REITs and MLPs are primarily valued based on their income distributions (dividends), the dividend line (honeydew/white) could be considered a more conservative valuation reference line.

Therefore, it might be more conservative to look at the price in comparison to the dividend line when analyzing MLPs and REITs. As it is with all valuation lines on a FAST Graph, they should be thought of as “valuation reference lines” that can be analyzed when determining sound buy, sell or hold decisions.

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long OHI and MPW.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.