To think that only 50 years ago there was no Intel (INTC) or Microsoft (MSFT) is mind-boggling. Certainly a lot has happened over the past five decades. But as it applies to investing in common stocks, something perhaps even more remarkable is now occurring. Our once, hyper growth technology stocks have morphed into stodgy old growth and income investments. Just like the technology industry itself, the pace at which this has occurred is mind numbing.

Five Technology Titans for Growth and Growth of Income

Fifty years ago investors looking for income would never have considered the leading technology stocks that brought us the information age. However, fast forward to present time, and these once fast growing growth stocks have morphed into dividend paying blue-chip, growth and income stalwarts. This is a mantle that usually was hung on the likes of Procter & Gamble (PG), Johnson & Johnson (JNJ) and General Mills (GIS).

This article will look at five high profile technology companies that as a group would offer a yield higher than the S&P 500. But perhaps even more importantly, they all possess consensus double-digit five-year earnings growth rates. Therefore, this list of blue-chip technology stocks is offered for consideration by investors seeking an increasing income stream with the added possibility for above-average growth. In other words, what distinguishes this group of dividend paying technology large caps is the potential for a faster rate of earnings growth.

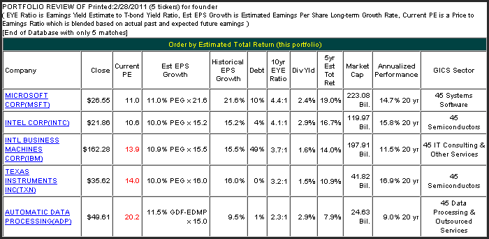

The following F.A.S.T. Graphs™ portfolio review is offered as a summary of the potential opportunity these companies represent. Note that these companies are listed in the order of highest potential future returns to the lowest, based on the consensus earnings estimates of leading analysts, with consideration given to the current valuation on each company. Although these numbers are hypothetical in nature, we submit that they represent a solid platform and a beginning point for a more comprehensive research effort.

Click to enlarge

Summary and Conclusions

Most astute investors would point out that the phrase “it’s different this time” is one of the most dangerous that could ever be stated regarding investing in common stocks or the stock market. We would agree that the basic principles underlying true investment practices are timeless, and will never change. However, it would be naïve to believe that business and industry are unchanging. As the world has evolved from the industrial age into the computer age or information age, much about how business is conducted has changed.

Most importantly, this change has created a business dynamic that, in its own right, is as revolutionary as the changes in the businesses themselves. We believe the most profound change lies in the velocity of how quickly modern-day businesses can generate and grow revenues, cash flows and earnings. In today’s environment, a business can start from virtually zero and rapidly grow into a multibillion-dollar enterprise, almost overnight. Throughout the history of business, never before has this kind of growth occurred or been possible. Technological innovation has been both game changing and disruptive.

As we review the Five Technology Titans covered in this article, we discover an irony regarding their investment merits as common stocks. These once, hyper fast growing, technological super stocks are beginning to behave more like stodgy old dividend producing blue-chip stalwarts. This brings to mind the old adage that the more things change the more things stay the same. Therefore, we believe it’s wise for investors to begin thinking about these Technology Titans differently than they have in the past. As their industry has matured, so have their businesses. As their businesses have matured, they are beginning to take on the characteristics of other mature enterprises in more traditional industries.

In part two of this two-part series we’re going to look at these Five Technology Titans from the perspective of price correlated to fundamentals. We’re going to cover an approximately 20 year period, where the first 8 to 10 years will be reflective of their hyper growth phases, and the remaining years more reflective of the traditional and typical business. We believe there are many lessons that a review of history can teach us.

However, we will not stop history because as investors we can only learn from the past, but we must invest for the future. Therefore, part two will also provide beginning insights into what the future might bring for these now technology industry-leading stalwarts. We believe that the insights that can be gained from such analysis are numerous. In today’s low interest rate environment, the opportunity to find solid income generating investments are hard to come by. Technology stocks have traditionally not been part of the search for income, but that has changed. We hope this two-part series establishes a foundation that income seeking investors can build upon.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.