Introduction

As a rule, I have never been very fascinated by the Transportation Sector. This is especially true regarding airlines and air transport companies. Nevertheless, there are two airlines and two air freight carriers in the Transportation Sector that I felt comfortable featuring in this article.

However, I still admit to having trouble suggesting that anyone invest in airlines. But, with that said the two airlines I’m covering in this article are considered among the best managed airlines in the world. Even then, I would be very cautious before investing in airlines despite the expected future growth that I will be illustrating later in the video associated with this article.

The operating fortunes of air freight couriers are similar in nature to the airlines. However, the big differentiator is that air freight demand is more consistent and predictable than passenger traffic. Consequently, the air freight couriers offer more appeal to me personally.

A Sector By Sector Review

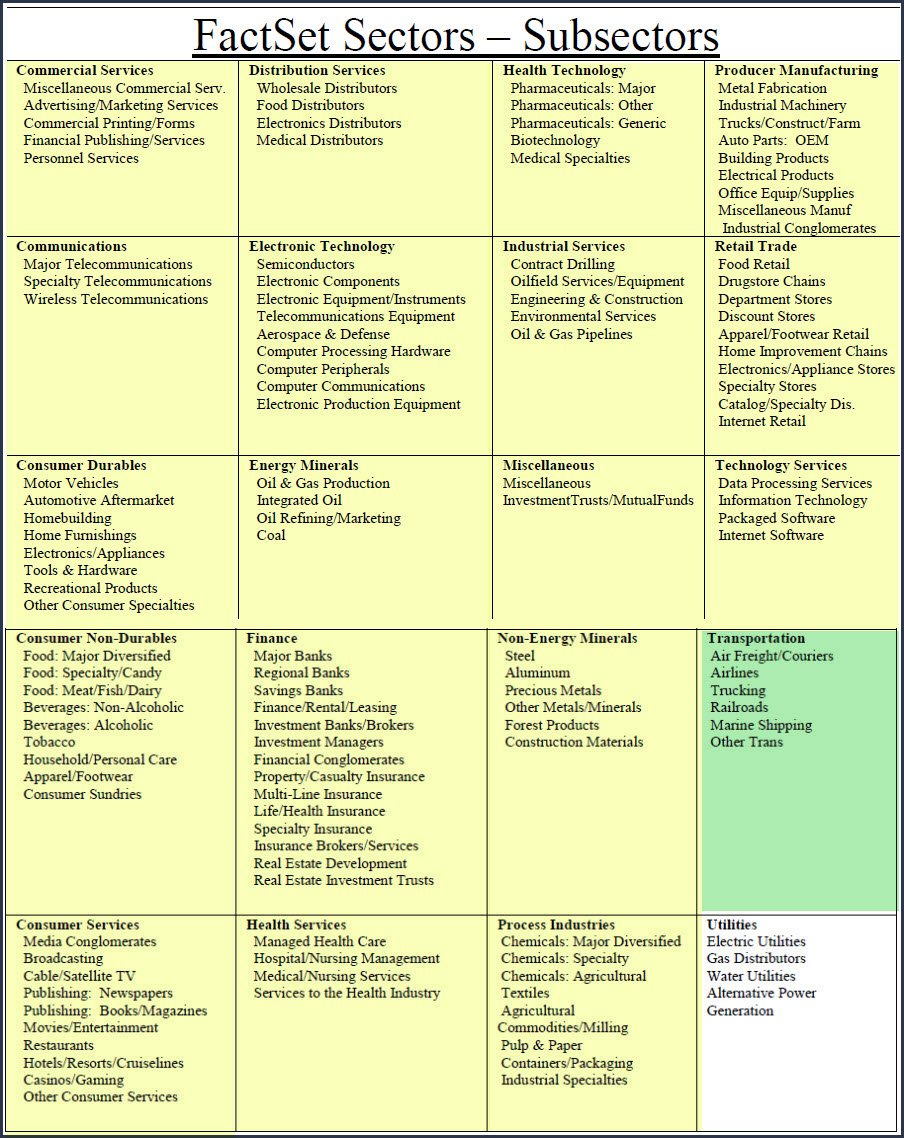

This is part 18 of a series where I have conducted a simple screening looking for value over the overall market based on industry classifications and subindustry classifications reported by FactSet Research Systems, Inc.

In part 1 found here I covered the Consumer Services Sector. In part 2 found here I covered the Communication Sector. In part 3 found here I covered the Consumer Durables Sector and its many diverse subsectors. In part 4 found here I covered Consumer Nondurables. In part 5 found here I covered companies in the Consumer Services Sector. In part 6 found here I covered the Distribution Services Sector. In part 7 found here I covered the Electronic Technology Sector. In part 8 found here I covered the Energy Minerals Sector. In part 9 found here I covered the Finance Sector. In part 10 found here I covered the Health Services Sector. In part 11 found here I covered the Health Technology Sector. In part 12 found here I covered the Industrial Services Sector. In part 13 found here I covered the Non-Energy Minerals Sector. In part 14 found here I covered the Process Industries Sector. In part 15 found here I covered the Producer Manufacturing Sector. In part 16 found here I covered the Retail Trade Sector. In part 17 found here I covered the Technology Services Sector.

In this part 18 I will be covering the Transportation Sector.

In each article in this series, I will be providing a listing of screened research candidates from each of the following industry sectors, the sector I’m covering in this article is marked in green:

Sector 18: Transportation Sector

- Air Freight/Couriers

- Airlines

- Trucking

- Railroads

- Marine Shipping

- Other Trans

A Simple Valuation and Quality Screening Process

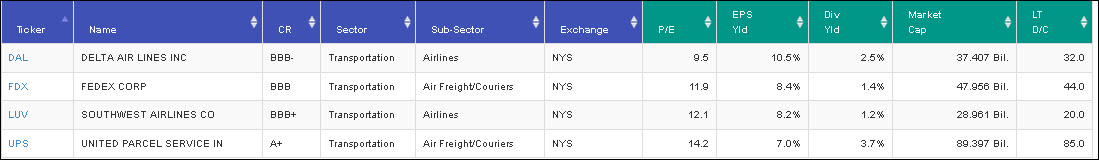

With this series of articles, I will be presenting a screening of companies that have become attractively valued primarily as a result of the bearish market activities experienced in 2018 from each of the above sectors. I will be applying a rather simple valuation and quality-oriented screen across each of the sectors. First, I have screened for investment-grade S&P credit ratings of BBB- or above. Next, I have screened for low valuations based on P/E ratios between 2 and 17. Finally, I have screened for long-term debt to capital no greater than 70%.

By keeping my screen simple, and at the same time rather broad, I will be able to identify attractively valued research candidates that I might have overlooked through a more rigorous screening process. In other words, I’m looking for fresh ideas that I might have previously been overlooking. Furthermore, I want to be clear that I do not consider every candidate that I have discovered as suitable for every investor. However, I do consider them all to be attractively valued. Additionally, I also believe that every investor will be able to find companies to research that meet their own goals, objectives and risk tolerances as this series unfolds.

Portfolio Review: Transportation Sector: 4 Research Candidates

FAST Graphs Screenshots of the 4 Research Candidates

The following screenshots provide a quick look at each of the 4 candidates screened out of over 19,000 possibilities. However, there are only 255 companies categorized as Transportation, and these 4 were the only ones I was comfortable presenting in this article. The company descriptions are provided courtesy of the Wall Street Journal. In the FAST Graphs analyze out loud video that follows the screenshots, I will provide additional details and thoughts on the possible attractiveness as well as the potential negatives of each of these research candidates.

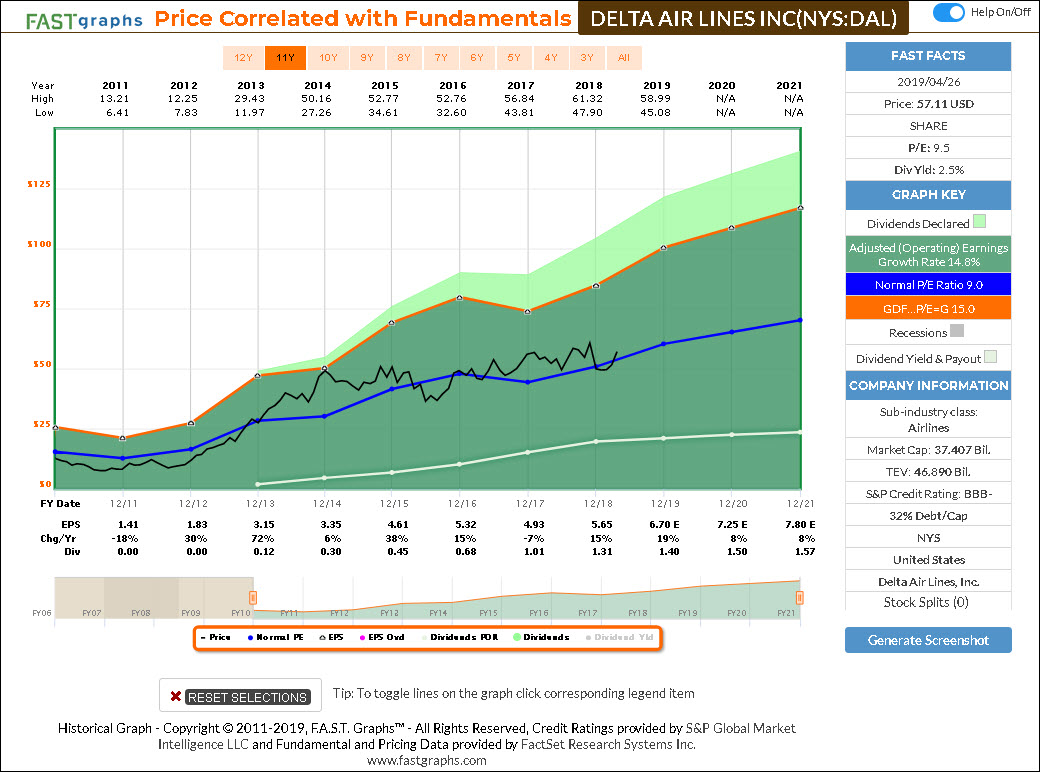

Delta Air Lines Inc (DAL)

Delta Air Lines, Inc. engages in the provision of scheduled air transportation for passengers and cargo. It operates through the following segments: Airline, Refinery. The Airline segment provides scheduled air transportation for passengers and cargo. The Refinery segment consists of jet fuel and non-jet fuel products.

The company was founded by Collett Everman Woolman in 1928 and is headquartered in Atlanta, GA.

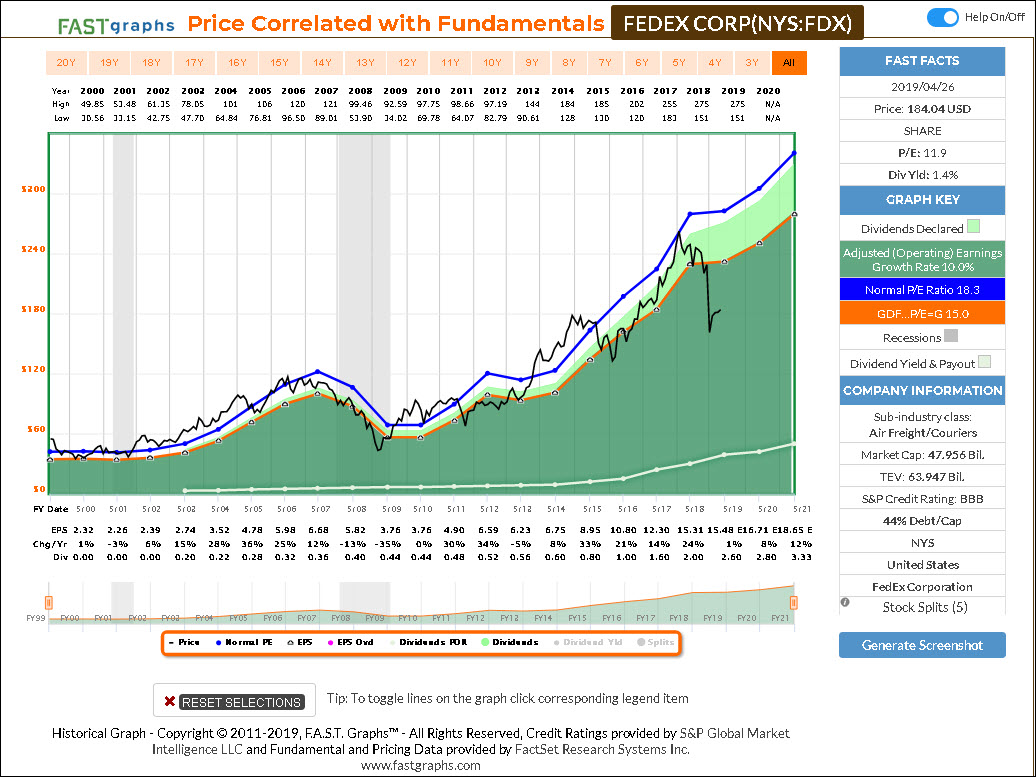

FedEx Corp (FDX)

FedEx Corp. engages in the provision of a portfolio of transportation, e-commerce, and business services. It operates through the following segments: FedEx Express, TNT Express, FedEx Ground, FedEx Freight, FedEx Services, and Other. The FedEx Express segment consists of domestic and international shipping services for delivery of packages, and freight. The TNT Express segment comprises of international express transportation, small-packaging ground delivery, and freight transportation.

The FedEx Ground segment focuses on small-package ground delivery services, and day-certain service to any business address in the United States, and Canada. The FedEx Freight segment offers less-than-truckload freight services across all lengths of haul. The FedEx Services segment provides sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions.

The company was founded by Frederick Wallace Smith on June 18, 1971 and is headquartered in Memphis, TN.

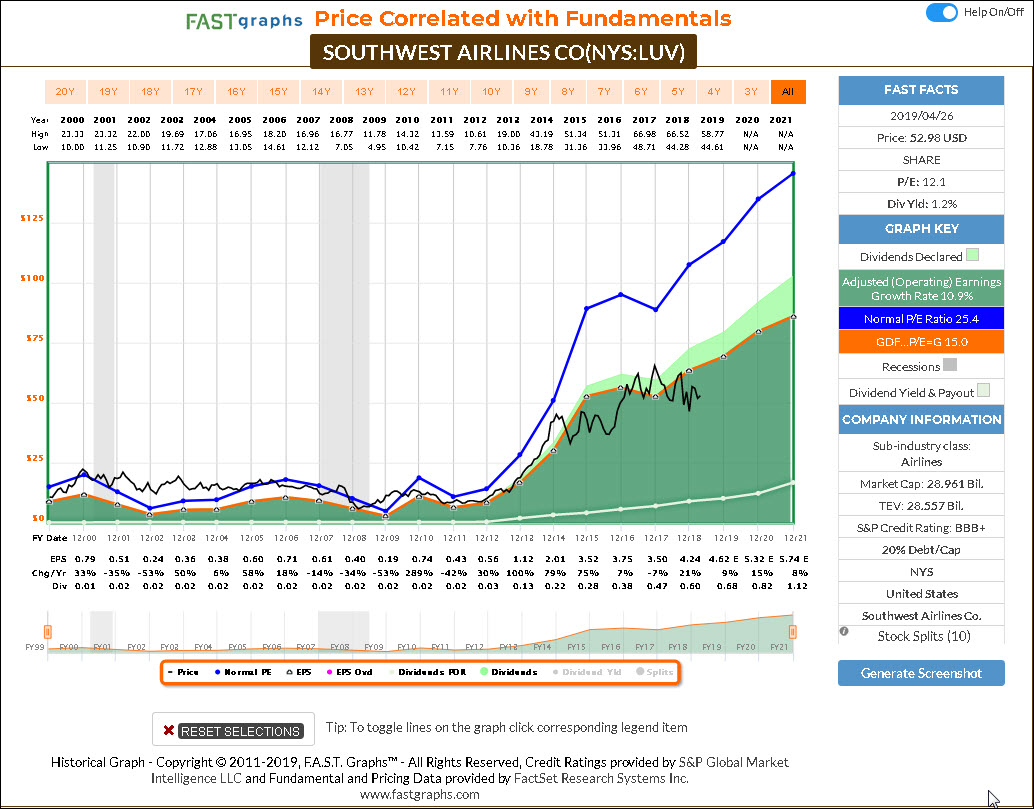

Southwest Airlines Co (LUV)

Southwest Airlines Co. engages in the management of a passenger airline. It operates in U.S. states, District of Columbia, the Commonwealth of Puerto Rico, Mexico, Jamaica, The Bahamas, Aruba, Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos.

The company was founded by Rollin W. King and Herbert D. Kelleher on March 15, 1967 and is headquartered in Dallas, TX.

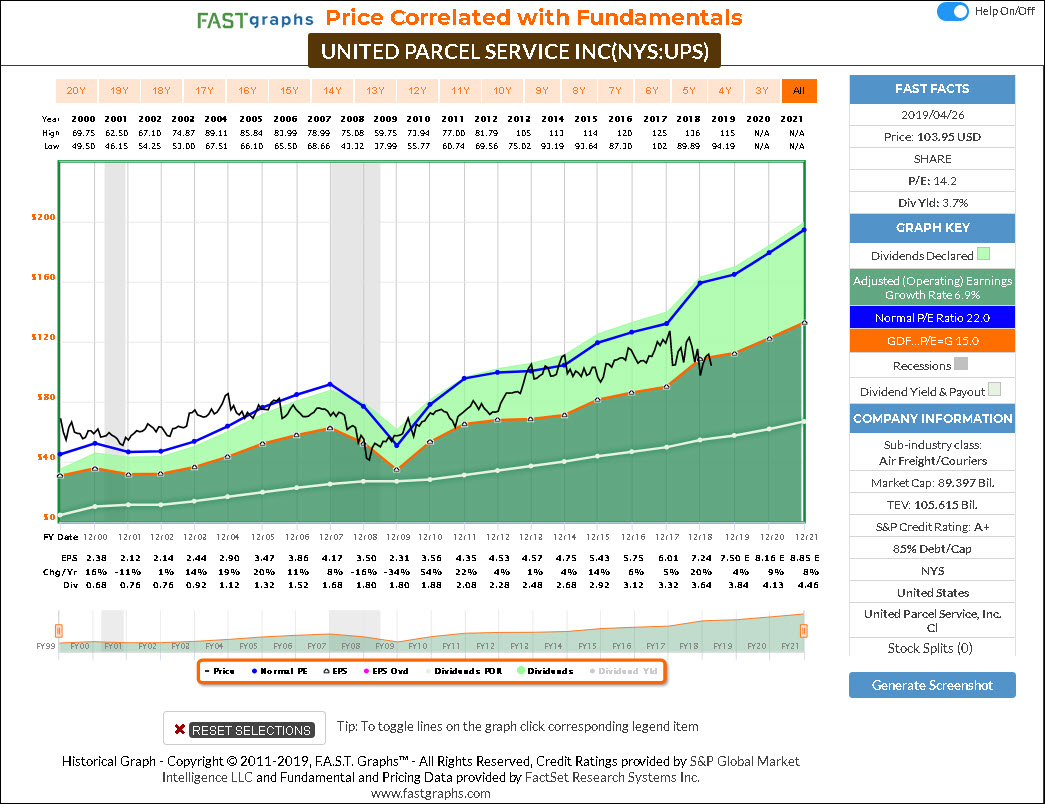

United Parcel Service (UPS)

United Parcel Service, Inc. operates as a logistics and package delivery company providing supply chain management services. Its logistics services include transportation, distribution, contract logistics, ground freight, ocean freight, air freight, customs brokerage, insurance, and financing. The company operates through the following segments: U.S. Domestic Package, International Package, and Supply Chain and Freight.

The U.S. Domestic Package segment offers a full spectrum of U.S. domestic guaranteed ground and air package transportation services. The International Package segment includes small package operations in Europe, Asia-Pacific, Canada and Latin America, Indian sub-continent, and the Middle East and Africa. The Supply Chain and Freight segment offers transportation, distribution, and international trade and brokerage services.

The company was founded by James E. Casey and Claude Ryan on August 28, 1907 and is headquartered in Atlanta, GA.

F.A.S.T. Graphs Analyze Out Loud Video:

In the following analyze out loud video I will be covering the 4 attractively valued research candidates in the Transportation Sector. Importantly, when I analyze out loud the 2 airlines, I will offer my personal insights into why I am not personally interested in investing in airlines.

Summary and Conclusions

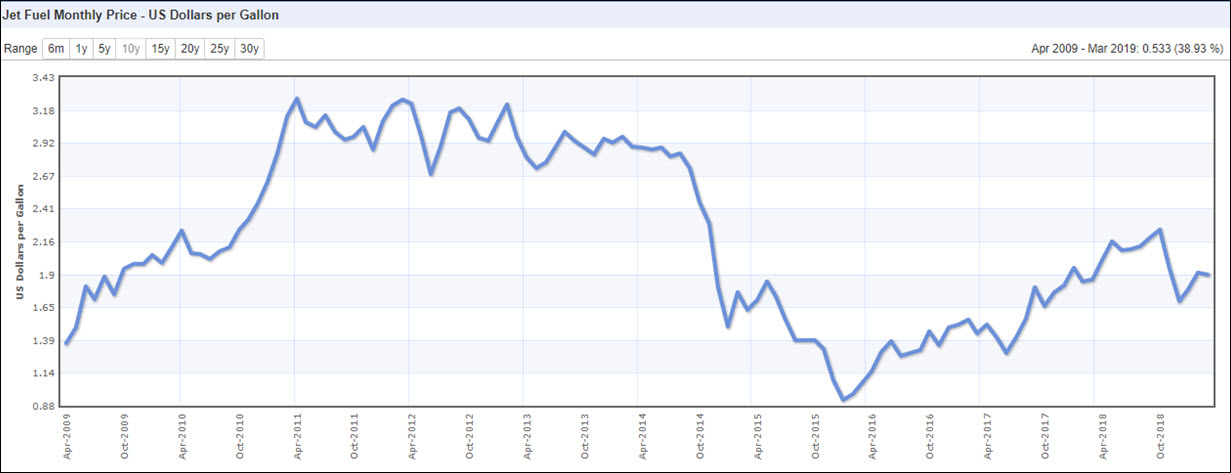

In my experience, I have found it extremely difficult for transportation companies to produce a steady stream of earnings and cash flow growth. Companies operating in this sector can see their operating results affected by fuel costs, demand, labor costs and even geopolitical events. Recently, airlines and air freight couriers have benefited from lower than average per gallon prices for jet fuel. The following graphic courtesy of IndexMundi shows that there is a clear correlation between the drop in price of jet fuel since 2009 and the accelerated earnings growth of the four companies covered in this article over the same timeframe. Consequently, prospective investors should be cognizant of the cut impact that potential rising oil prices, and therefore, jet fuel prices could affect future earnings.

Nevertheless, for the time being at least, all four of the companies covered in this article appear to be attractive total return candidates. There are also some interesting opportunities for the dividend growth investor amongst this group as well. However, in the final analysis, prospective investors would need to be diligent regarding the economic factors that could hurt future operating results discussed in the previous paragraph.

Disclosure: Long UPS,FDX,LUV

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.