New York Stock Exchange Homebuilding Stocks

I am a value stock investor that believes in the long-term ownership of good businesses purchased at attractive valuations, today we will be looking at homebuilders. In my humble opinion and experience, this is the surest and perhaps most prudent way to build wealth through investing in the stock market. However, value investing does not always provide instant gratification. In fact, the exact opposite is likely to be true more often than not. The reason is plain and simple. Value often comes when good companies go out of favor, this is especially true in bull markets like we have been in the last several years. Almost by definition, when stocks are out of favor it further implies that their near-term performance may not be all that attractive.

Recent studies have validated those assertions by pointing out that in the short run sentiment rules stock price action. Of course, the primary sentiments are fear and greed. I have always stated that fear is the most powerful and therefore most dangerous. However, at the same time, do not underestimate how dangerous greed can be. Nevertheless, stocks that have short-term momentum because of positive investor sentiment can and often do defy logic in the short run. Simply stated, in the short run, highly popular stocks can become significantly, and I might add, dangerously overvalued. However, this can continue for months or even years. As I often say, they do not ring a bell at the top or bottom of the stock market.

On the other hand, the same studies have pointed out that over the longer run (which the studies defined as 7 years or more) fundamentals rule. In other words, the company’s intrinsic value based on fundamentals will eventually and inevitably manifest. This is often referred to as reversion to the mean from a statistical perspective. However, I simply see it as the market continuously seeking efficiency or value. This contrasts with the notion of an always efficient market. Rather than being always efficient, I see the market as always seeking efficiency. Therefore, an efficiently-valued market is eventually what the investor will get. But at any point in time the market may not be efficiently valuing stocks.

Nevertheless, and with all that said, momentum investing can be very profitable over short to intermediate periods of time. For example, we are currently seeing a lot of extremely, and I would add, dangerously overvalued stocks in the tech sector. Moreover, these high valuations have gone on for quite some time. Years in many cases. Still, since fundamentals do not support these nosebleed valuations, investors purchasing them are simply acting as proverbial “greater fools.” The greater fool theory simply suggests that you foolishly pay more for a stock than it’s truly worth solely on the basis that a fool greater than you will come along and pay you more. This sometimes works for a while, but eventually bites you where it hurts.

When Value and Momentum Converge: Homebuilding Stocks DR Horton Inc. (DHI), Lennar Corp. (LEN) and Pultegroup, Inc. (PHM)

Considering what this article has stated thus far, it would logically follow that it might be very profitable if you could find stocks with tremendous momentum that were simultaneously undervalued. If you can do that, this combination could possibly provide the opportunity for short term, intermediate term and ultimately long-term strong performance all wrapped in one neat package.

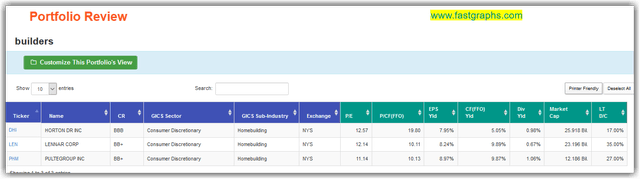

One industry that appears to have both momentum and attractive valuation going for it is the primary homebuilders listed on the New York Stock Exchange. The following FAST Graphs portfolio review lists the 3 top homebuilders in order of largest market to smallest:

Portfolio Review Homebuilding Stocks

Statistically, all 3 of these homebuilding stocks – companies look very attractive. They are all available at low P/E ratios, and they all offer earnings yields above my 6 ½% minimum threshold. Additionally, the long-term debt to capital ratios are all modest. However, although statistics technically do not lie, they can also be very misleading. As the 3 adjusted (operating) earnings and price correlated FAST Graphs clearly illustrate, these 3 companies’ business models were devastated during the Great Recession.

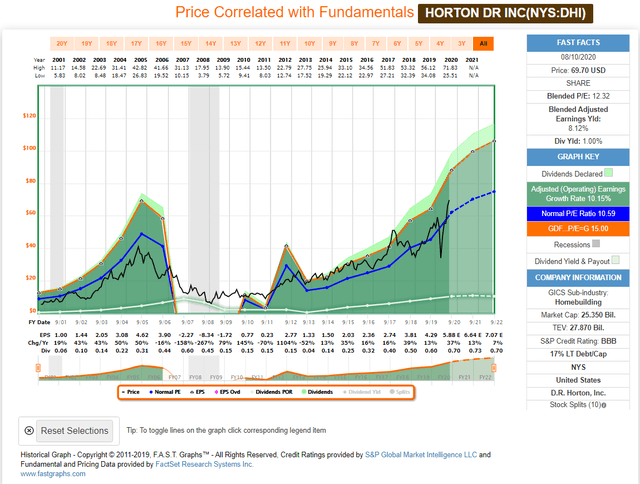

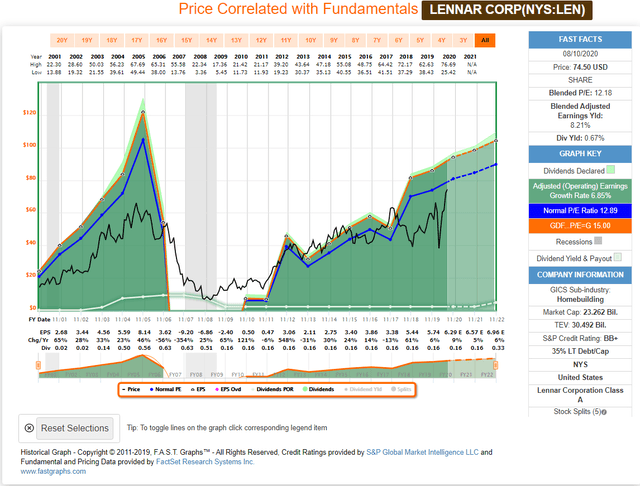

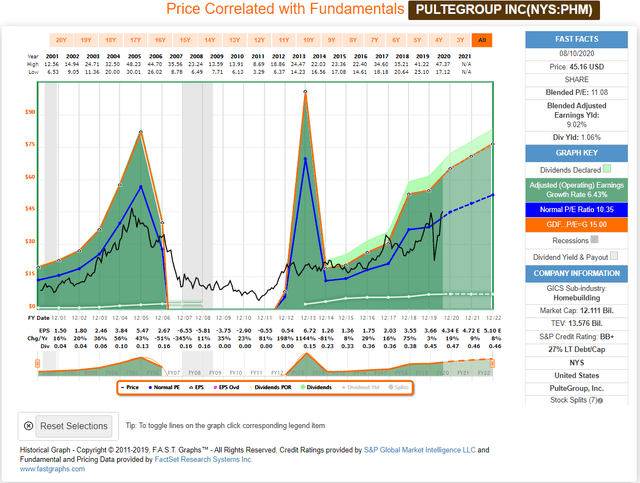

As a result, from peak to trough these homebuilders’ stock prices collapsed 80% to 90% and each company suffered losses for several years just prior to, during and immediately after the Great Recession of 2008 and 2009. On the other hand, all 3 did exceptionally well during the recession of 2001. Nevertheless, we should not ignore the reality that homebuilding and home purchases can be very sensitive to economic conditions. On the other hand, if interest rates and mortgage rates remain at historical lows, there certainly exists the possibility for continued support for this industry. At least over the intermediate term.

I believe it is also important to point out how similar each of the operating histories of the 3 major builders have been. It is almost as if you took the names off of the graphs you would not be able to tell one from the other. My point being that this industry tends to perform both on an operating basis and a price performance basis almost identically. Furthermore, even though I am only covering what I consider to be the 3 top builders, I also examined several smaller but still significant competitors. These included Toll Brothers Inc. (TOL), KB Home (KBH), MI HOMES INC. (MHO), and Meritage Homes (MTH). The operating histories and price action of these additional competitors mirrored the results of the big 3 that I am featuring with this article. This is an industry that performs in tandem from one company to the other.

Therefore, as you examine each of the earnings and price correlated graphs below, note the extreme similarities in the operating results and price history of each of these companies. Especially take note of how each of them rallied off their bottoms starting on March 31, 2020. Although each of these 3 companies have experienced over 90% gains since March 31, they all remain reasonably valued. Therefore, it appears that given their momentum and low valuations there may still be money to be made by investing in them.

D.R. Horton, Inc.

Lennar Corporation

PulteGroup, Inc

FAST Graph Analyze Out Loud Video – the Homebuilding Industry

In the following analyze out loud video I am going to illustrate both the opportunity and the risk I see with investing in homebuilding stocks. As a bonus, in addition to the big 3 covered in this article, I will provide a quick overview of several smaller homebuilders to include Toll Brothers Inc., KB Home, MI Homes Inc., and finally Meritage Homes Corp. My purpose for providing these bonus looks is to illustrate how similar every company this industry has performed relative to their competitors.

Summary and Conclusions

As a long-term investment strategy, value investing has been proven to work. However, that does not mean to say that value investing always works immediately. In fact, one of the real negatives about value investing that keeps several people from following this discipline is the lack of short-term performance that often occurs. Moreover, value investing can be especially challenging during bull markets. As we all know, bull markets are generally associated with high and rising stock prices. Investors tend to love bull markets.

On the other hand, value investors tend to find bull markets very challenging. The reason is simple, it is very hard to find value when optimism is at its peak. Consequently, the only value typically to be found in a bull market will be with companies that are out of favor. Sometimes, there is no good reason for a company to be out of favor. In other times, there are justifiable reasons for companies going out of favor. The trick is to determine whether it is a temporary interruption or a permanent impairment.

If the interruption is truly temporary, then it logically follows that an undervalued stock in a bull market is very likely a bargain. Therefore, this allows you as investors to exploit and incorporate the most fundamental rule of investing. Buy low and sell high. Regardless, value investing can work immediately if you can identify undervalued out-of-favor stocks as they come back into favor. I believe this is currently what you are seeing with the homebuilding stocks covered in this article. In other words, when low valuation converges with momentum, the results can be extraordinary. On the other hand, investors also must realize that value investing usually requires patience. However, if you do identify true value stocks, being patient is inevitably rewarded.

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: No Positions.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.