Blue-Chip Dividend Growth Stocks

I love blue-chip dividend growth stocks that consistently grow their businesses and their dividends year after year. However, as much as I love blue-chip dividend growth stocks, I simultaneously hate their stocks when they become overvalued. With this video I am going to cover what I consider to be some of the best businesses and my favorite dividend growth stocks that have become very risky investments.

The risk of course comes from the excessive valuations that the market has currently placed on them. I would invest in every one of these companies if I could purchase them at a reasonable valuation. However, you can overpay for even the best businesses, and by doing so, turn them into lousy investments.

Additionally, I am going to cover what I consider to be some very important nuances about valuation that are often misunderstood. Overvaluation does not simultaneously mean lose money. In fact, when a stock has momentum, owning it when its overvalued can be extremely profitable. However, I would argue it is also extremely risky when that happens, and point out that the future outcome inevitably will be bad. The exact timing cannot be known, but the ultimate result is. The point being that when you invest in overvalued stocks, you leave the realm of prudent investing and entered the realm of speculation. But the most important point is to be cognizant that you are speculating when you are, and not deluding yourself into believing that you are investing prudently when you are not.

My Favorite Dividend Growth Stocks

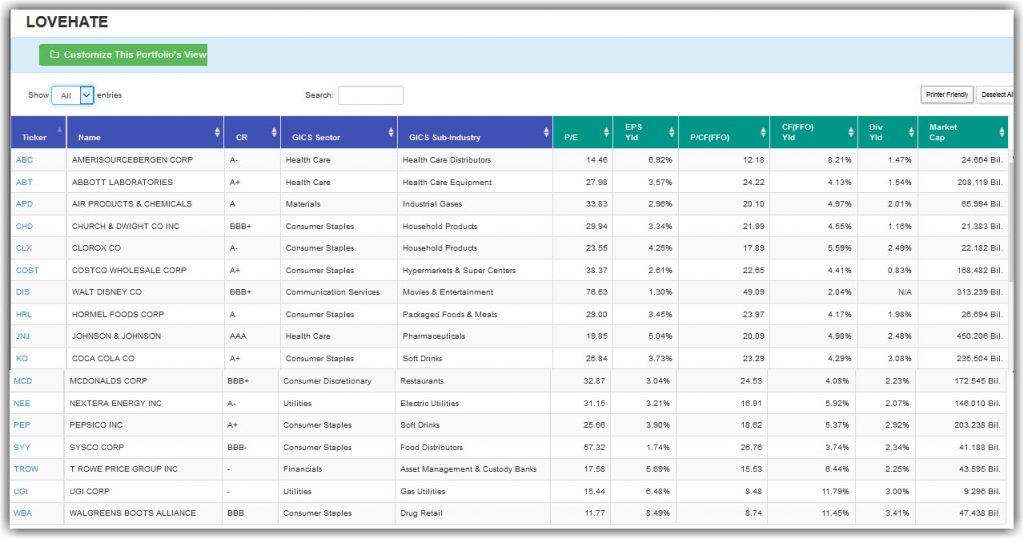

Nextera Energy (NEE), Church & Dwight (CHD), Clorox (CLX), Walt Disney (DIS), Sysco Corp (SYY), Costco Wholesale (COST), Air Products & Chemicals (APD), McDonalds (MCD), Hormel Foods (HRL), Abbott Laboratories (AABT), Coca Cola (KO), PepsiCo (PEP), Johnson & Johnson (JNJ), T Rowe Price (TROW), UGI Corp (UGI), AmerisourceBergen (ABC), Walgreens Boots (WBA)

FAST Graphs Analyze Out Loud Video:

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long TROW,UGI,ABC,WBA at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.