Investing Thesis

When investing for dividend growth there are several key attributes that I consider crucial for long-term success. My definition of long-term success is first and foremost to generate a steadily-rising dividend income stream, and secondarily, the opportunity to generate a reasonable level of capital appreciation. With this article I will present 12 dividend growth stocks that currently meet my “dividend growth magic formula for success.”

The dividend growth magic formula: quality+ value+ above-average dividend yield+ future growth = long-term success. In truth, there is no such thing as a magic formula for investment success. However, the above characteristics, when available, will be as close to a magic formula for dividend growth investing as you could ever expect. However, after such a long and extended bull market, finding stocks that fit every criterion in the above formula has become extremely difficult – to say the least. Unfortunately, finding quality stocks at fair valuation is the biggest challenge facing investors today.

The “magic formula” presented above has been the foundation of my personal investing approach over my entire career spanning almost five decades. However, it is vitally important to realize that there are many nuances and gradations associated with each of the above formulas’ components. Therefore, the above formula is more conceptual than it is exact. Next I will take a deeper look at the finer points of each of these components to illustrate my point.

Quality

Like most of the components of my magic formula, quality is a somewhat esoteric metric. Also, quality can be measured in degrees such as extremely high-quality, good quality or investment grade or above quality. In this regard, investment grade credit ratings can be a good indicator of quality, but not the only indicator. To be considered investment grade, a company must possess a credit rating of BBB or higher.

Debt levels are another quality characteristic that I evaluate. Generally, for blue-chip dividend growth stocks I like to see debt no higher than 50%. But most importantly, I try to be comfortable that the company’s cash flow generating capabilities are capable of handling any debt they have. However, when circumstances dictate, I might accept a higher level of debt.

Operating consistency is another quality characteristic that I evaluate. The more consistent – the better, but few companies produce perfect operating histories. With this consideration I’m looking at earnings, cash flows and historical dividend records. Nevertheless, as it is with all the components of the formula, there are different levels of quality.

Value

Fair or attractive valuation is vitally important. No matter how much I like the company, I will not knowingly pay more than I think the business is worth. In today’s market environment, finding quality dividend growth stocks at fair value has proven to be my biggest challenge. This is especially true for the dividend growth segment thanks to today’s low interest rates.

Above-Average Dividend Yield

Above-average dividend yield is a somewhat arbitrary component of my magic formula. This is because my dividend growth strategy focuses more on dividend income and future growth of that income than it does capital gain potential. In other words, this component is more relevant to my personal investment objective. However, a dividend growth stock with a below-average dividend yield but an above-average dividend growth rate could still be attractive to me if it meets all of the other criteria in my formula.

Future Growth

To an extent, the concept of growth as it relates to dividend stocks is an oxymoron. I believe that investors should be cognizant of the fact that higher-yielding dividend growth stocks typically do not grow as fast as pure growth stocks. Investors should recognize that they might be required to give up a certain amount of growth in order to achieve a higher level of dividend yield. Rarely will you find high growth and high yield available in the same company.

Stated differently, it is quite common that large high-quality blue-chip dividend paying stocks offer a dividend to compensate shareholders for a lack of high future growth. Importantly, this also relates to the best use of shareholder capital. When the company does not have the opportunity to invest their capital at higher rates than they are currently earning, the better use of that capital is to return it to shareholders in the form of the dividend.

12 Companies That Currently Meet “The Magic Formula” Criteria

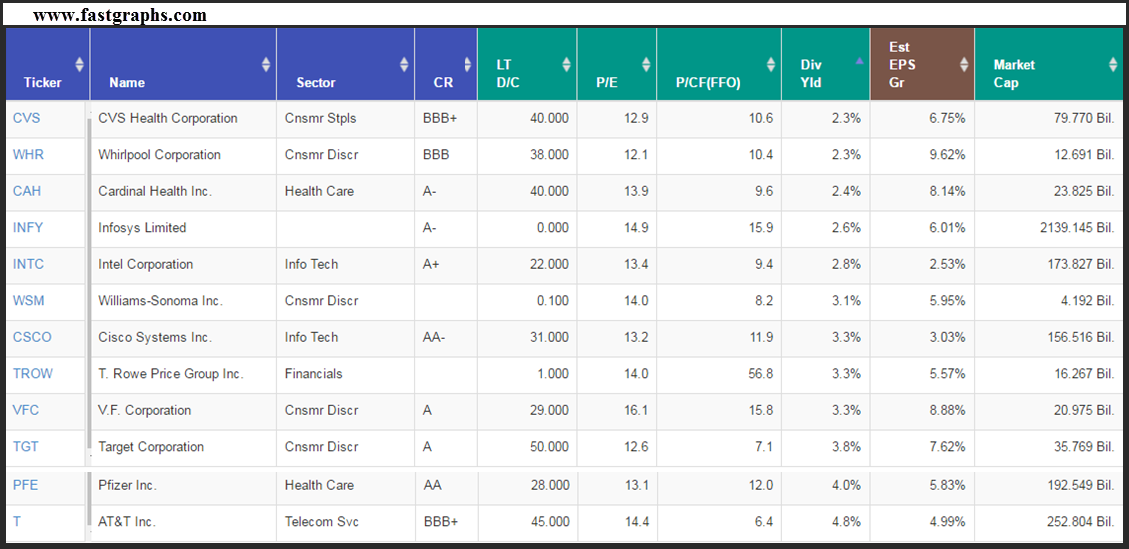

The following table lists the 12 dividend growth stocks that my research has identified that I feel comfortable offering as attractive dividend growth stock research candidates in today’s market. They are listed in dividend yield order from lowest to highest.

The table headings are organized in order of the components of my “magic formula for dividend growth stocks.” The credit ratings and long-term debt to capital relate to quality, the P/E ratio and price to cash flow columns relate to value, the dividend yield column indicates above-average dividend yield and the estimated earnings per share (EPS) growth rates relate to future growth potential.

CVS Health Corporation (CVS), Whirlpool Corporation (WHR), Cardinal Health Inc (CAH), Infosys Limited (INFY), Intel Corporation (INTC), Williams-Sonoma Inc (WSM), Csco Systems Inc (CSCO), T. Rowe Price Group (TROW), VF Corporation (VFC), Target Corporation (TGT), Pfizer Inc (PFE) and AT&T Inc (T):

A Video Offering A More Comprehensive Look At These 12 Attractive Dividend Growth Stocks

Summary and Conclusions

In my opinion, dividend growth investing is a proven and prudent strategy that is applicable for investors primarily concerned with receiving a reliable and growing dividend income stream. Dividend growth investing is more about protecting assets than it is about growing them. In this regard, high-quality dividend growth stocks will not necessarily produce greater capital appreciation than the general stock market. On the other hand, if you are attentive to valuation at time of purchase, your total returns might be equal to or better than the market.

However, when applying the “dividend growth stock magic formula” presented in this article, it is highly likely that this strategy will produce a higher level of current and future dividend income than the market. Beating the stock market on a total return basis is a difficult and a risky proposition. Beating the stock market on a current and future total dividend income basis is a very attainable goal and objective. But with a little application of common sense and prudence, a quality dividend growth strategy prudently applied could give you both higher income and market beating total returns in the long run.

Feb 15, 2017

Feb 17, 2017

Feb 20, 2017

Feb 21, 2017

Mar 8, 2017

Mar 8, 2017