Intrinsic Value

In today’s video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation is going to look at how to calculate the intrinsic value of a common stock and why it is so important to long-term investing success.

Every investor in common stocks is faced with the challenge of knowing when to buy, sell or hold a common stock. This challenge will be approached differently by a true investor than it would by a speculator. This video will be focused on assisting true investors who are desirous of a sound and reliable method that they could trust and implement when attempting to make these important buy, sell or hold investing decisions.

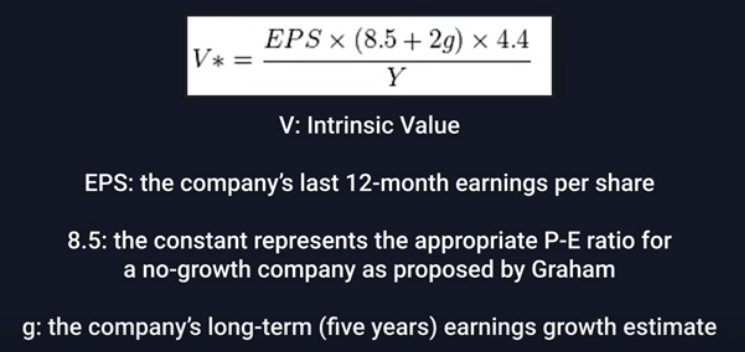

It logically follows that true investing requires a diligent focus and comprehensive understanding of the true worth of any business under consideration.

We can call it intrinsic value, fundamental value, either fair value or true worth, it really doesn’t matter. What matters is that we are making sound and safe investing decisions that are based on reasonable fundamental values, and that, therefore, we will be able to fully participate in any of the stocks that we invest in.

In this video Chuck will go over General Mills Inc (GIS), American Electric Power Co (AEP), Spire Inc (SR), Conagra Brands Inc (CAG), Cencora Inc (COR), Amdocs Ltd (DOX), Elevance Health Inc (ELV)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long GIS,COR, DOX, ELV

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.