Calculating Fair Value

In this video, Part 2 of 3, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation will go over how you can calculate and assess intrinsic value (fair value) based on the future expectations of the growth of any stock you are looking at for long-term investment success.

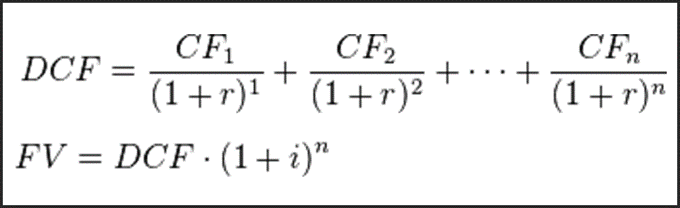

Calculating fair value based on growth expectations is what this video is about. In Part 1 Chuck focused primarily on calculating the intrinsic value of a common stock based on an analysis and review of historical information and data. Although Chuck strongly believes there is much that investors can learn by studying the past, he even more strongly believes that since we can only invest in the future, that it is also implicit that we embrace a rational method of forecasting.

We cannot escape the obligation to forecast, our results depend on it. Our forecasts should not be mere prophecy and we should not simply guess, nor should we play hunches. Instead, we must endeavor to calculate reasonable probabilities based on all factual information that we can assemble. Analytical methods should then be employed based upon our underlying earnings driven rationale, providing us reasons to believe that the relationships producing earnings growth will persist in the future.

In this video Chuck will go over Global Payments Inc (GPN), American Electric Power Co (AEP), Ameriprise Financial (AMP), Davita Inc (DVA), Johnson & Johnson (JNJ), Untied States Steel Corp (X)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long GPN, AMP, JNJ

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.