Beat The Overvalued S&P 500

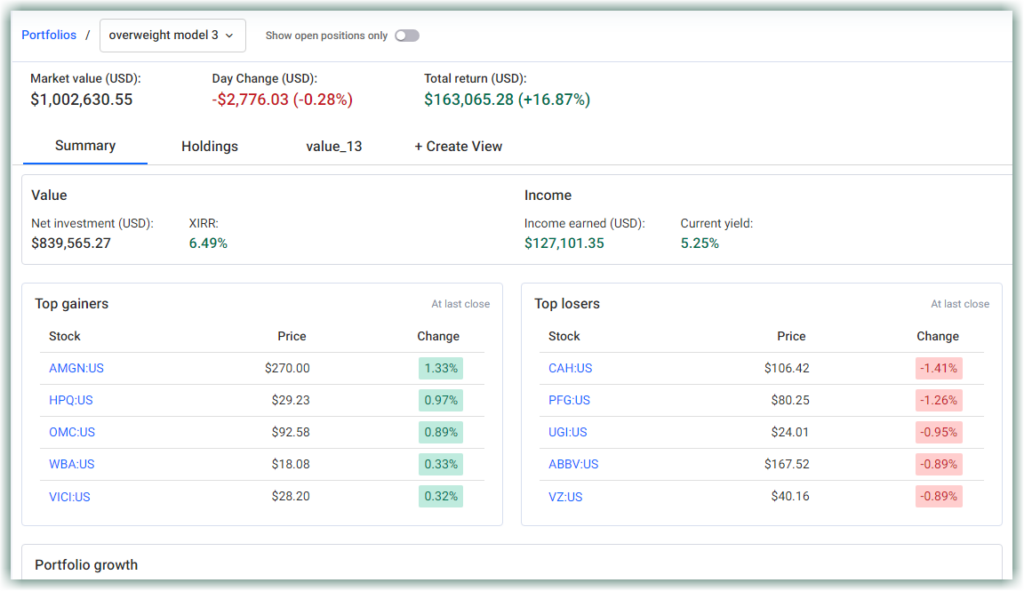

On August 24, 2021, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation, built three portfolios for dividend income with different objectives. In this video, Part 3, Chuck will do an update on Model Portfolio Number 3 to see how it’s performed against the S&P 500. The portfolio was to get maximum income out of the portfolio but still try to deal with risk at the maximum extent possible.

We hope you enjoyed this series. This was all about designing portfolios to meet specific needs and specific investment objectives. That is what investing is all about.

Here are links to the three Model Portfolios from August of 2021:

Here is a link to Part 1 of this current series.

Here is a link to Part 2 of this current series.

In this video Chuck will cover Abbvie (ABBV), Amgen (AMGN), Franklin Resources (BEN), Cardinal Health (CAH), Chemours (CC), Eastman Chemical (EMN), Enterprise Products Partners (EPD), HP Inc (HPQ), Ingredion (INGR), JPMorgan Chase (JPM), Altria Group (MO), Merck & Co (MRK), Omega Healthcare (OHI), Omnicom Group (OMC), Principal Financial Group (PFG), UGI Corp (UGI), VICI Properties (VICI), Verizon Communications (VZ),Walgreens Boots Alliance (WBA)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long ABBV, AMGN, CAH, CC, EMN, EPD, HPQ, INGR, JPM, MO, MRK, OHI, OMC, PFG, UGI, VICI, VZ, WBA

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.